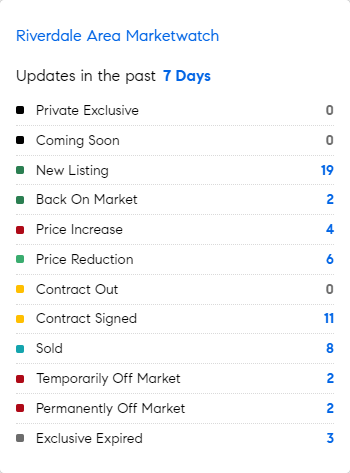

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 6/12/2023 – 6/19/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

Might a boost in the inventory of for sale homes come from ……institutional owners? Just two years after Starwood Capital Group purchased a portfolio of thousands of single-family rental homes from Pretium Partners in 2021 for more than $1 billion, the firm is already looking to sell more than 2,000 single-family rentals. As of the end of March, the REIT owned slightly more than 3,200 single-family rentals, a portfolio valued at $1.26 billion. (BLOOMBERG)

The UK and US are separated by over 4,000 miles yet share a similar story around home rentals: Rising interest rates have slammed the brakes on the runaway market for UK home sales. In contrast, the rental market is still red hot. Newly let properties are 25% more expensive than before COVID hit in 2020, and still rising at 9% in May compared with 2022. (FT)

U.K. inflation remains among the highest of all developed economies at 8.7%, more than double that of the US. Germany is at 6.1%, Italy at 7.6%, and France at 5.1%, Israel at 4.7%, all higher than the US. Japan at 3.5% and Saudi Arabia at 2.6% are lower.

BlackRock and JPMorgan have helped set up Ukraine reconstruction bank, a fund aimed to attract billions of dollars in private investment to assist rebuilding projects in this war-torn country…..and bound to fuel inflation on building supplies and commodities? (FT)

* Sweden – one of the few countries that did not lock down during COVID – is experiencing pain in its Office commercial property sector too as interest rates rise: one of the largest office landlords in the capital was downgraded to junk status by Moody’s Investors Service. (YAHOO)

The 3 stages/waves of inflation we have experienced over the past few years are explained by Paul Donovan, senior economist of UBS, as follows:

1. The first wave, which was about consumer durable goods, was demand-led. The surge in demand caused by monetary and fiscal stimulus that came during pandemic lockdowns in the form of things like stimulus checks and near-zero interest rates. This first wave of inflation is over, with durable goods prices falling in the U.S. in “outright deflation.”

2. The second wave was caused by the energy shock that came from the war in Ukraine, and this is fading too. Natural gas and oil prices surged after Russia invaded Ukraine, owing to the country’s status as a major energy exporter, but have since dropped dramatically.

3. The third wave of inflation, the one we’re getting now, is this unusual profit-led inflation story, which occurs with firms towards the end of the supply chain. This is consumer facing companies or near consumer facing companies, increasing margins and pretending it’s all due to costs and other factors. They sneak in a margin increase….or “profit-led” inflation. Retail profits surged 86% between the first quarter of 2020 and the 4th quarter of 2022, according to Fed data, while GDP rose roughly 20% over the same period. That’s all consumer-facing greedflation.

How does the third wave end? Consumers revolt as they run out of money or become angry, or worse…..government intervention, price controls, etc. (YAHOO)

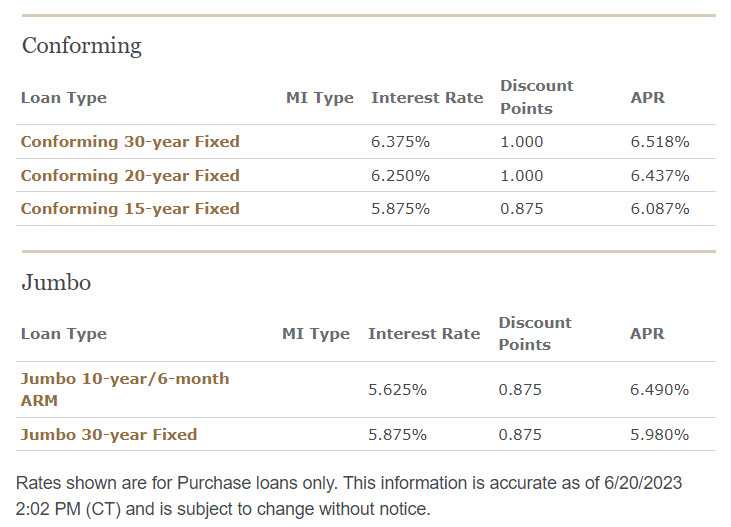

Courtesy of Aaron Pisano, Wells Fargo