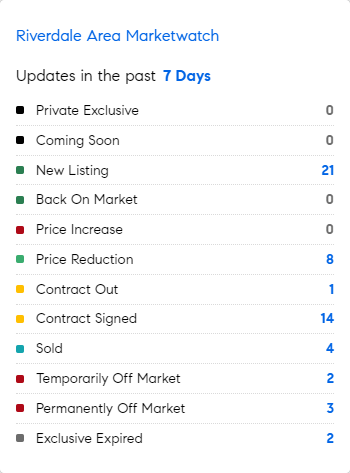

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 3/18/2024 – 3/25/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* More energy-efficient homes, less materials waste and lower carbon emissions in the construction process are among the sustainable advantages of modular housing, fueled by technology that speeds up the process and automates things normally done manually. However, the sector remains relatively nascent in the U.K. and U.S. versus places like Sweden and Japan.

Experts highlight that the sector, along with the construction industry more widely, has faced economic headwinds in recent years. (CNBC)

* Austin housing prices soared more than 60% from 2020 to the spring of 2022, possibly the biggest leap in US history. According to the Freddie Mac House Price Index, prices have fallen more than 11% since peaking in 2022, the biggest drop of any metro area in the country……as was to be expected. Yet still up over 43% since 2020. What is the lead cause of prices to come down? Lower agent commissions? Nope! Supply. Construction. Lots of it. (WSJ)

* State and local governments in California have committed tens of billions of dollars to build more affordable housing. A new complex for some of the neediest low-income people doesn’t use any of it: By forgoing government assistance and the many regulations and requirements that come with it, SDS Capital Group’s 49-unit apartment building it is financing in South Los Angeles will cost about $291,000 a unit to build. By contrast, the roughly 4,500 apartments for low-income people that have been built with funding from a $1.2 billion bond measure L.A. voters approved in 2016 have cost an average of $600,000 each….more than double! (WSJ)

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was at 6.74% as of March 14th, marking the second weekly decline, down from last week when it averaged 6.88%. It was the lowest reading since early February. A year ago at this time, it averaged 6.60%. “The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time,” said Sam Khater, Freddie Mac’s Chief Economist. “Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.”

Source: Freddie Mac