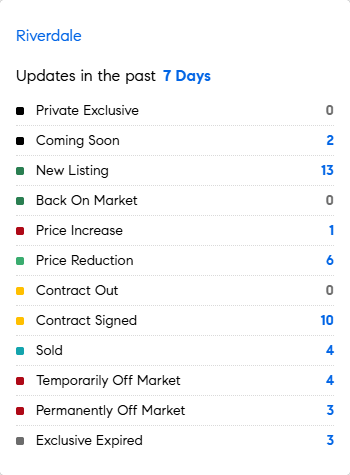

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 2/2/2026 – 2/9/2026

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

DID YOU KNOW?

* Will new regulations – that have helped prevent fraud, money-laundering and other illegal activities in banking – come to the CRYPTO world soon? Crypto is attractive to criminals primarily due to its pseudonymity, decentralized nature, the speed and irreversibility of cross-border transactions, and the initial lack of comprehensive regulation.

* Ed Massey of COMPASS California sent me this good reminder:• About two-thirds of U.S. household wealth is home equity

• Home values have risen in 78 of the last 83 years

• Homeowners have roughly 44x the net worth of renters

• Over the last five years, the median homeowner increased net worth by about $150,000.

* If you are interested in learning more about architectural planning why not take an online course? This place has many! We are never too old to learn MORE!

* In 2024, the US government took in $5 trillion in taxes….but spent $6.8 trillion, leaving a $1,8 trillion shortfall that is added to our (massive, growing) national debt. This is unsustainable. Can spending be cut? Can government spending be made more efficient? Should tax rates be raised? Should estate tax exemptions be revised? Should those who earn their wealth/income via tax-free-income from pledged assets not be in a position to avoid taxes? As of late 2025, the top 1% of US households (roughly 1.3 million families) hold approximately $52-55 trillion in combined wealth. A smaller subset, the top 0.1% (roughly 130,000 households), hold about $22.14 – 22.48 trillion. Can we inflate prices to reduce the value of the debt? At some point, we will need to address all the above….. unless of course we are all comfortable paying $1 trillion per year in INTEREST on the debt…that trillion does not build a single bridge or feed a single citizen…

* What can happen if you replace real estate tax revenues with spending taxes? A sales-tax-heavy tourist county can raise much more revenue than an agricultural or “bedroom” community, creating massive inequality. Shifting to sales taxes can make the overall tax structure more burdensome on low-income residents. High consumption taxes can drive consumers to shop in other jurisdictions.

* Around $3 trillion – around 4-5% of the entire credit market – is estimated to be circulating in the private credit markets in the US: While major regulators like the Federal Reserve and SEC have increased their scrutiny, they still lack direct jurisdiction over many private funds, leading to significant gaps in transparency regarding valuations and underlying risks.

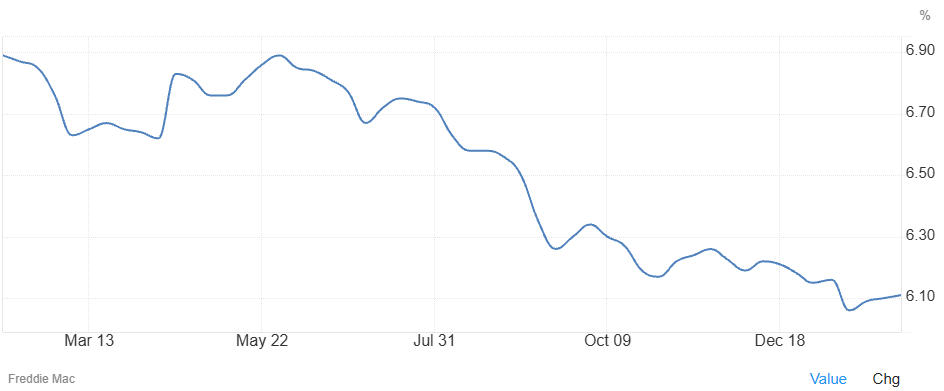

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage rose marginally to 6.11% as of February 5th loosely rising for a third straight week from the lowest level since September 2022 of 6.06%, according to data from Freddie Mac. “For the last several weeks, the 30-year fixed-rate mortgage has remained at its lowest level in years. The combination of improving affordability and availability of homes to purchase is a positive sign for buyers and sellers heading into the spring home sales season,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac