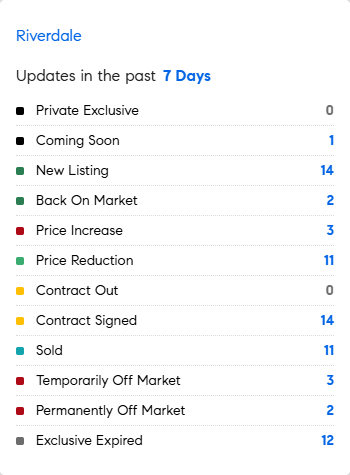

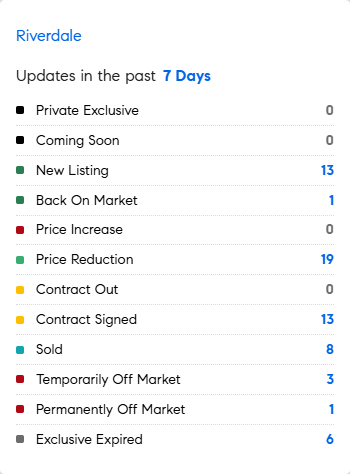

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 11/3/2025 – 11/10/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

DID YOU KNOW?

* As predicted yesterday, it appears the government shutdown is about to end, the longest in history. But…. it only extends funding for the federal government until Jan. 30th, 2026, less than 3 months from now. It includes full-year funding for the Agriculture Department, military construction and the legislative branch as well as guaranteeing the reversal of federal layoffs initiated during the shutdown. A vote has also been promised on extending enhanced Affordable Care Act subsidies by mid-December. (WSJ)

* 70% of ultra-luxe home sales in Dubai are off plan, well before a building is constructed. More luxury homes were sold in Dubai in recent quarters than any other city, including New York or London, attracting ultra wealthy consumers from around the globe via super-low taxation and super-low crime rates. Luxe home prices in Dubai are still about a third of that in New York and London. China’s pre-sales system has been widely blamed for fueling excess supply contributing to a debt pile-up for developers, leading to an epic slowdown that’s dragged on for more than 4 years.(Bloomberg)

* The rich and the very rich live on very different budgets and are often lumped together as one: In Paris, a luxury room runs nearly $1,000 a night: the average price at the most expensive hotel however is $2,600. In New York, ultra-luxury hotels cost $1,560 a night compared with the average luxury-room rate of $472. (WSJ)

* The Labor Department estimated Americans’ electric bills in September jumped 5.1% from a year earlier. (WSJ)

* Would a 50-year mortgage reward the banks, mortgage lenders and home builders while people pay far more in interest over time and die before they ever pay off their home? The purpose of a longer-term mortgage would be to lower the monthly payment for homeowners. The longer the term of the loan, the smaller the principal needed each month to pay it off in full. But such a plan has other trade-offs. For a median priced $415,200 home, with an interest rate of about 6.3%, and 20% down, the monthly payment of principal and interest would be $2,056. If you raise the length to 50 years, at the same interest rate, that payment would be $1,823, a savings of $233 per month. (CNBC)

* Is gambling being rebranded as “prediction markets?” Gambling in households increases the odds of domestic violence by over 10x, and gambling has the highest suicide rate of any addiction — roughly 1 in 5 people with a gambling addiction attempt suicide. Gambling addiction receives almost no federal funding. Legalization makes it worse. In states with legal sports betting, personal bankruptcies jump 28%. It disproportionately affects low-income families, men, and, increasingly, young people. 90% of high school students surveyed in New York said they’d gambled at least once in the past year. Supporters claim that legalizing raises tax revenue: for every dollar collected, states lose over $4 in net costs. Are we monetizing people’s addictions? (Scott Galloway)

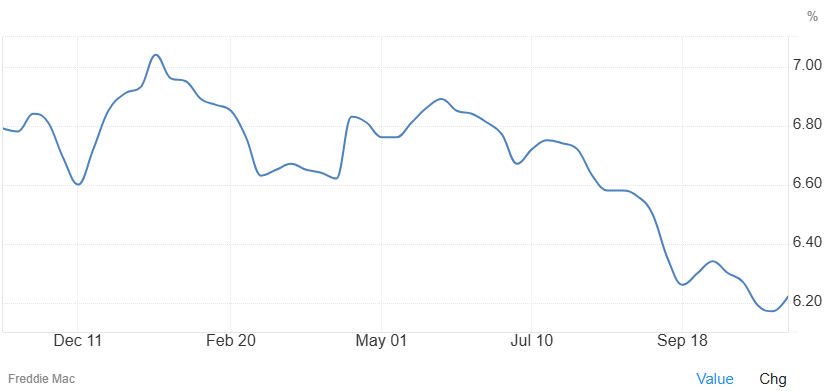

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage rose to 6.22% as of November 6th, 2025, rebounding from the lowest since early October 2024 of 6.17% seen last week, according to a survey of lenders by mortgage giant Freddie Mac. “This week the 30-year fixed-rate mortgage averaged 6.22%. On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving,” said Sam Khater, Freddie Mac’s chief economist

Source: Freddie Mac