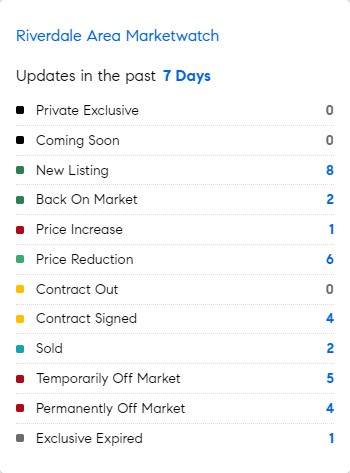

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 11/20/2023 – 11/27/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 7.41% from 7.61%. Applications to refinance a home loan increased 2% for the week and were 4% lower than the same week one year ago. Applications for a mortgage to purchase a home increased 4% week to week but were still 20% lower than one year ago. (CNBC)

* In 2022, the FBI received 11,727 real estate-related fraud complaints with losses of over $396 million, an 86% increase versus 2020 levels. Another good reason to work with a professional buyers agent? 77% of real estate professionals surveyed reported seeing an increase in seller impersonation fraud attempts within the last 6 months, with 54% experiencing at least one seller impersonation fraud attempt during that period. (YAHOO)

* Bank of America economists evaluated renting versus buying, comparing monthly rent and mortgage payments (they included property taxes in their calculation, but excluded home insurance, utilities and maintenance costs). Their analysis found rent was still cheaper than mortgages in all but two of 97 major Metro Areas as of October, despite the fact that both rents and mortgage payments have gotten more expensive, relative to median income, since 2020. It’s worse in some places than others: In Los Angeles, where as a percentage of median income, mortgage payments and tax are 83% and rent is 41%; or San Jose, where it’s 80% versus 26%; or San Francisco, where it’s 71% versus 29%; or San Diego, where it’s 74% versus 38%; or Seattle, where it’s 55% versus 25%. But, but….all of this reflects monthly payments, not equity-building. Anyone who doesn’t factor in equity building when comparing renting to buying loses legitimacy in my books….

* The federal Energy Information Agency publishes a winter fuels outlook, forecasting how much households using different fuels will pay for heat from November through March. This year heating-oil customers will face pay around $1,856, followed by propane users, at $1,337, electricity users, at $1,063 and gas users, at just $605. But that number doesn’t distinguish between older electric-resistance appliances, such as electric baseboard heaters and electric space heaters – which are much more expensive to run – and highly efficient electric heat pumps. Heat pump users can expect to pay just $639 for electricity from October to March – more than 60% less than homes with electric resistance heaters.

* In 1985, Warren Buffet was worth around $500 million, a big number for sure! He was around 53 years old……and in the past 40 years his net worth has spiraled past $110 BILLION, showcasing yet again how many of the fortunes of our world are created by those above the age of 50 as the effects of compounding kick into high gear….. The average age of the UHNWI population is 64.8 and 63.6 for men and women, respectively and I’d bet most did not win a lottery…..chances are the majority of them made their biggest gains after the age of 50 via the compounding effects of their investments.

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was 7.29% as of November 22, dropping for the fourth consecutive week and 50bps below the 23-year high from the end of October. The outcome mirrored the notable decline in long-term Treasury bond yields since late October, reflecting expectations of an end to the U.S. Federal Reserve’s rate hike cycle. A year ago, the average rate on the 30-year fixed mortgage was 6.58%. “Mortgage rates continued to decrease heading into the Thanksgiving holiday,” said Sam Khater, Freddie Mac’s Chief Economist. “In recent weeks, rates have dropped by half a percent, but potential homebuyers continue to hold out for lower rates and more inventory. This dynamic is reflected in the latest data showing that existing home sales have fallen to a thirteen-year low.”

Source: Freddie Mac