Compass National Real Estate Insights – January 2024

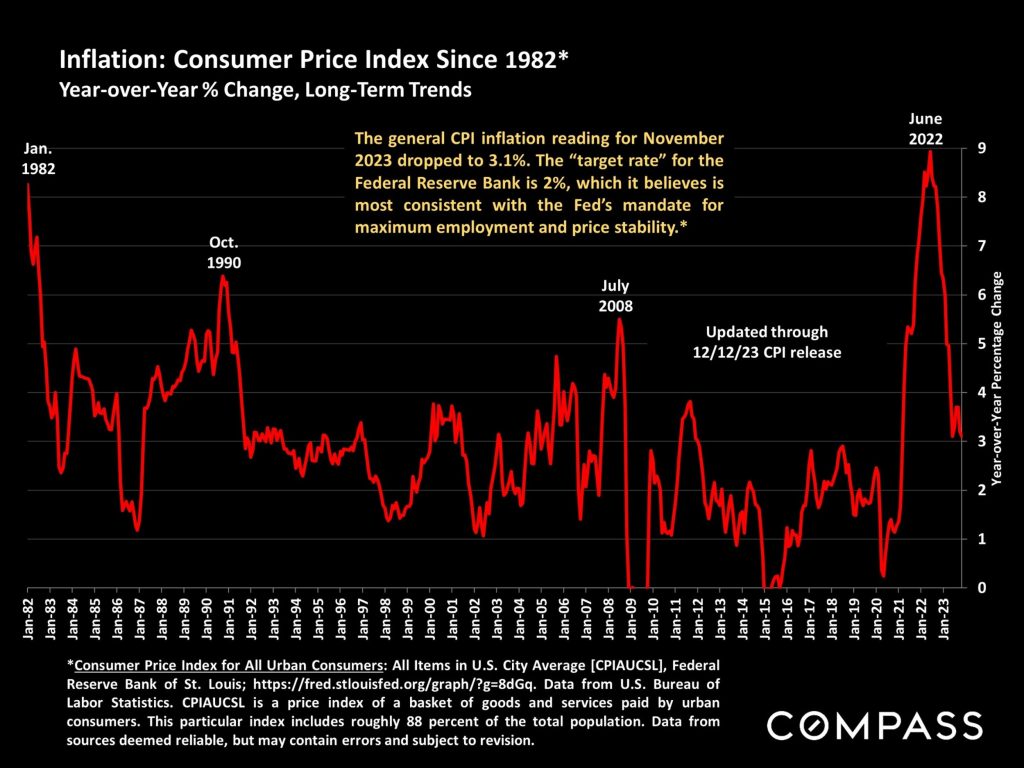

“Inflation around the globe is slowing way faster than expected. If economists are right…next year [will see] inflation back to normal levels for the first time in three years.”

– from The Wall Street Journal, 12/24/23, “For Much of the World, Inflation Will Be Normal in 2024 — Finally”

“Inflation around the globe is slowing way faster than expected. If economists are right…next year [will see] inflation back to normal levels for the first time in three years.”

Wall Street Journal, 12/24/23, “For Much of the World, Inflation Will Be Normal in 2024 — Finally”

“Consumer sentiment…soared 14% in December [due to] substantial improvements in how consumers view the trajectory of inflation…All age, income, education, geographic, and political inflation groups saw gains in sentiment…[2024] inflation expectations plunged from 4.5% last month to 3.1% this month.”

University of Michigan, Consumer Sentiment Index, December 2023

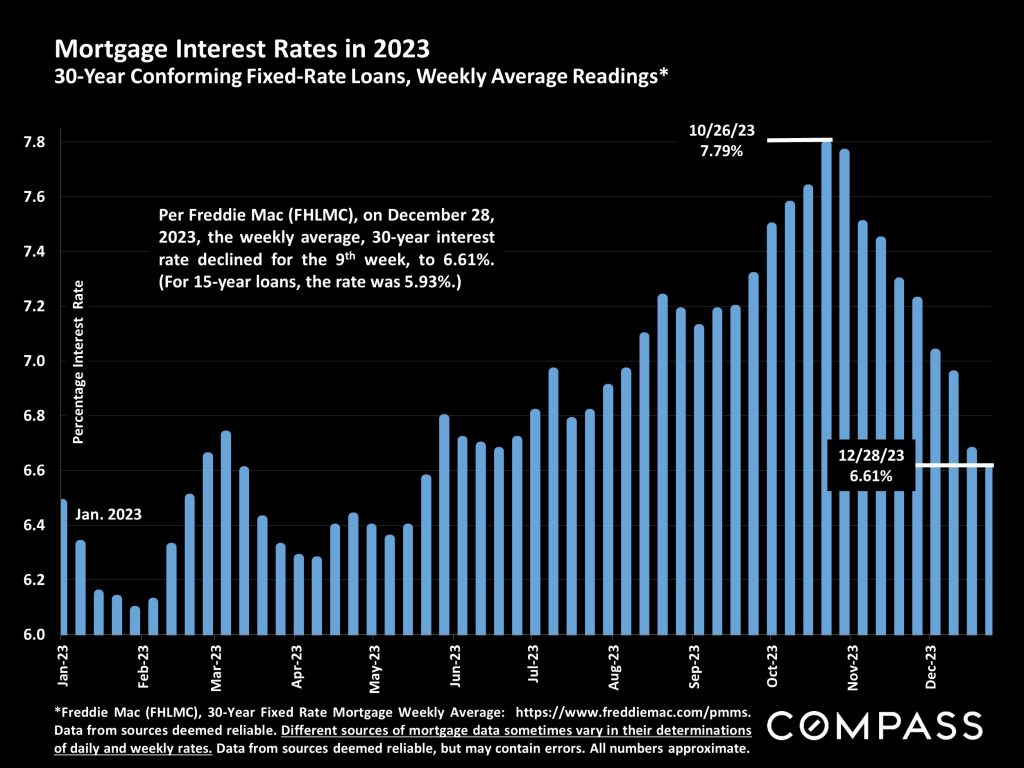

“Housing starts surged to a six-month high, sales of previously owned homes picked up from a 13-year low and builder optimism boosted by increased interest from prospective buyers. Meanwhile, Americans’ home-buying plans rose this month by the most in more than a year. The bounce back comes as mortgage rates have declined by…the biggest drop over a comparable period since 2009.” Bloomberg News, 12/20/23

“The 30-year fixed-rate mortgage remained below 7%…after 17 consecutive weeks above. Lower rates are bringing potential homebuyers who were previously waiting on the sidelines back into the market…Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.”

Freddie Mac, 12/21/23 & 12/28/23

Since changes in economic indicators didn’t begin to affect market psychology until early-mid November, right before the mid-winter slowdown, and the homebuying process takes 30 to 60 days from loan qualification and offer acceptance to closed sale, significant effects of these changes on real estate market statistics will not begin to show up until January data comes in.

Mortgage rates have plunged since October,

and are currently expected to drop further in 2024.

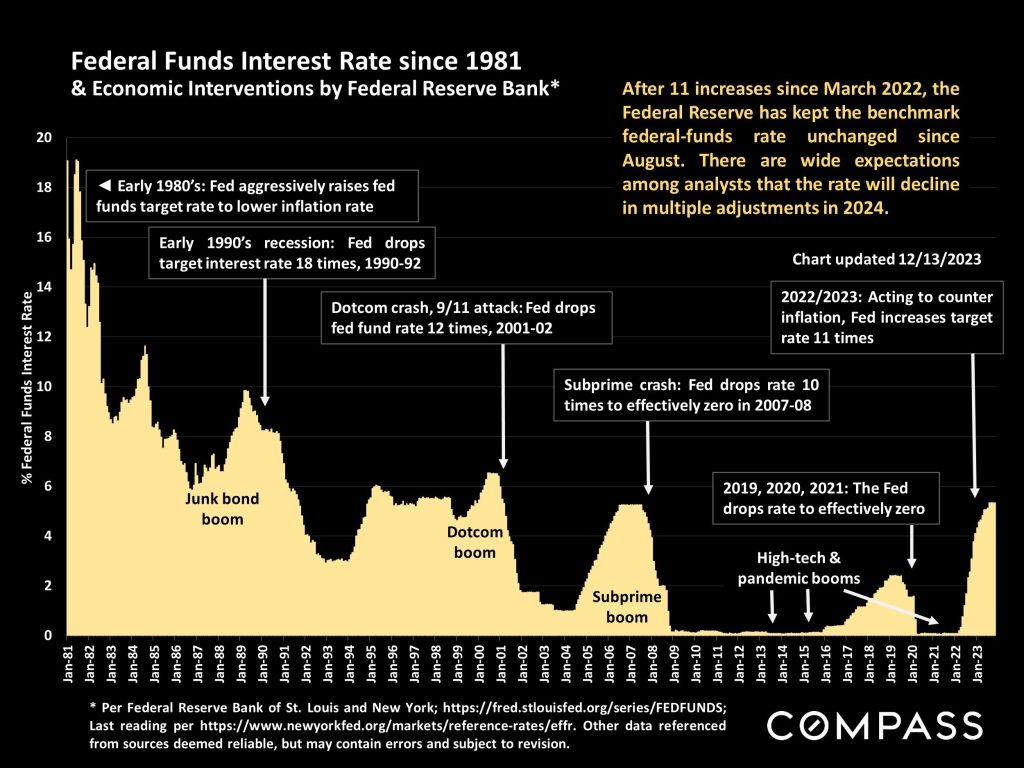

Inflation is a huge factor in interest rates, consumer confidence, and housing and financial markets. Most analysts believe inflation will continue to fall in 2024.

Consensus opinion is that the Fed will soon begin to drop its benchmark rate. Once it determines a change is appropriate, the Fed often acts quickly and decisively.

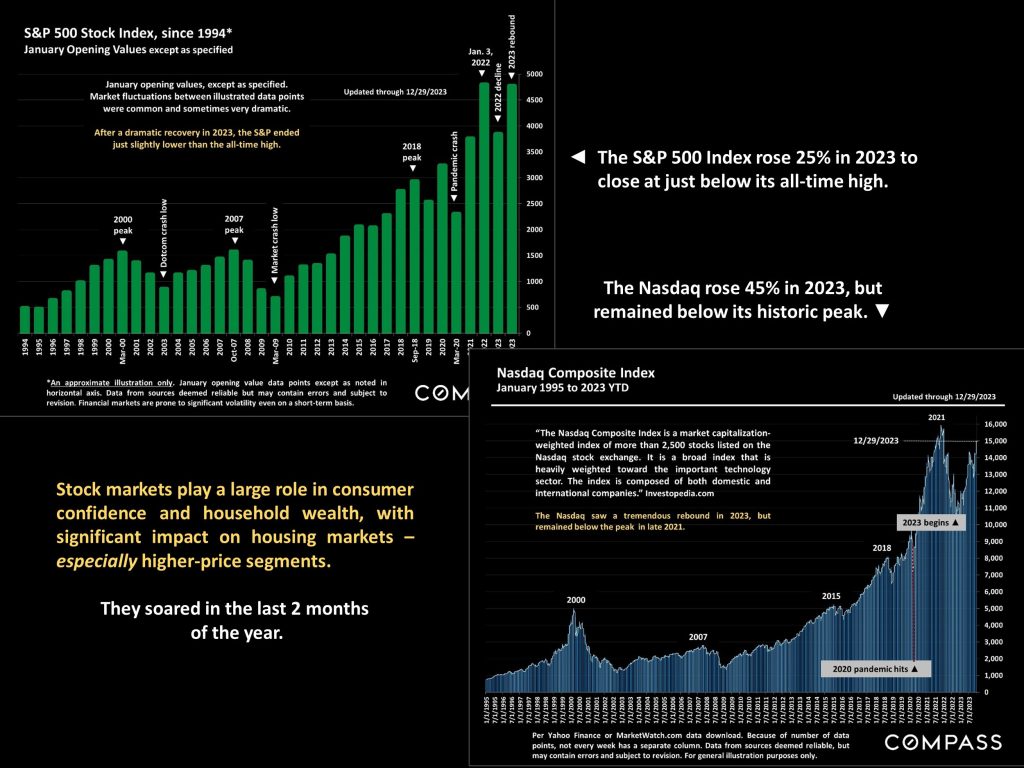

Rarely have stock markets swung so dramatically from pessimism regarding economic trends to ebullient optimism as in the last 2 months of 2023.

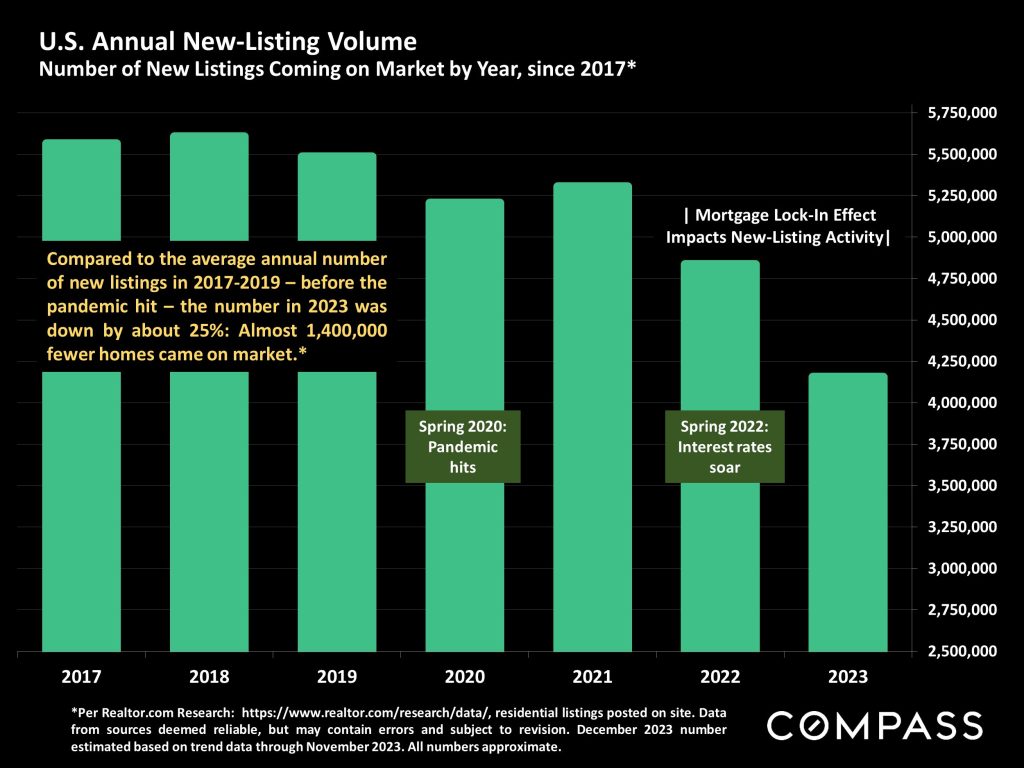

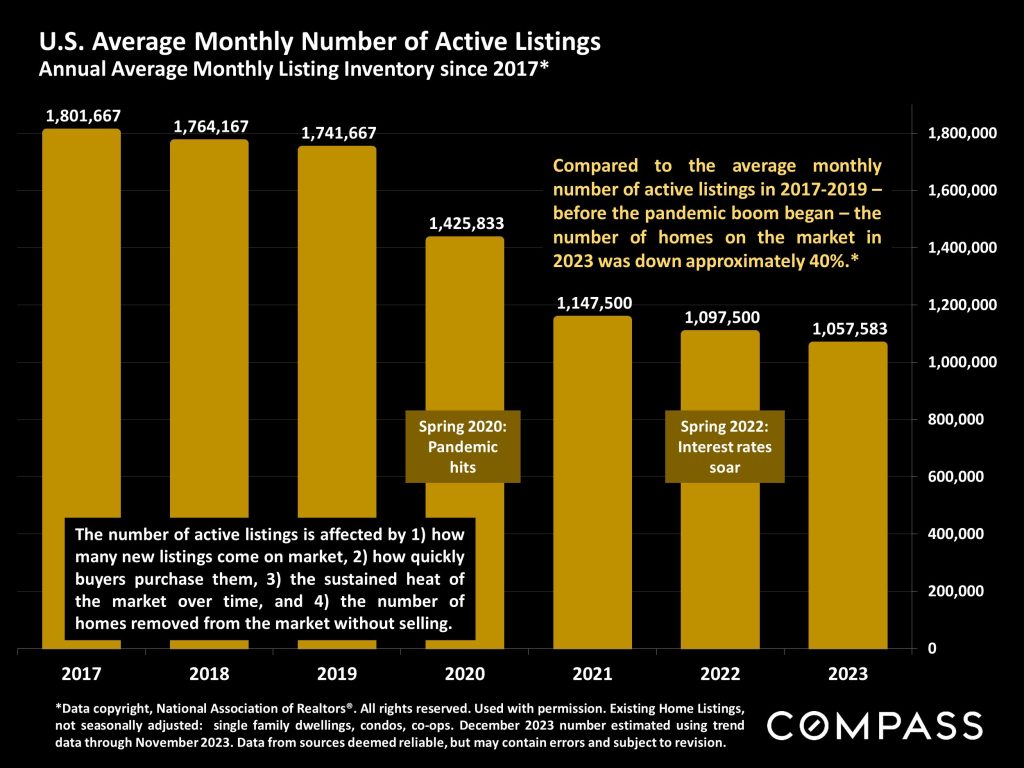

The effect of high interest rates on the number of new listings coming on market has had a staggering impact on supply & demand dynamics.

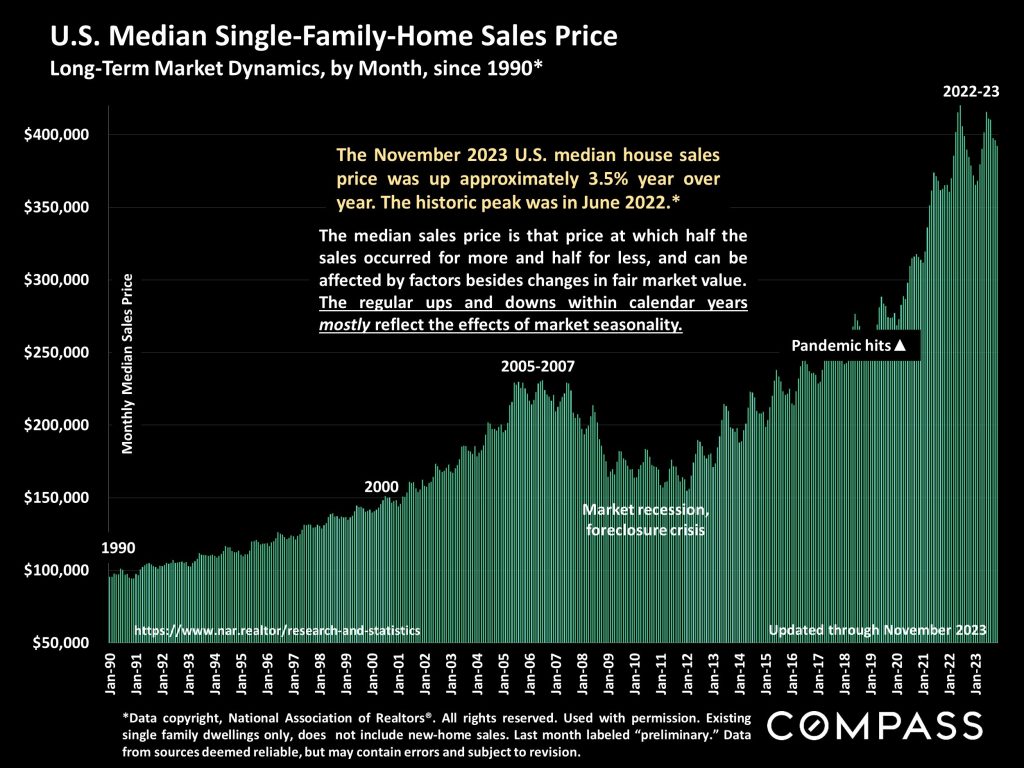

Even as rising interest rates negatively affected affordability, the extremely low supply of homes for sale has maintained upward pressure on home prices.

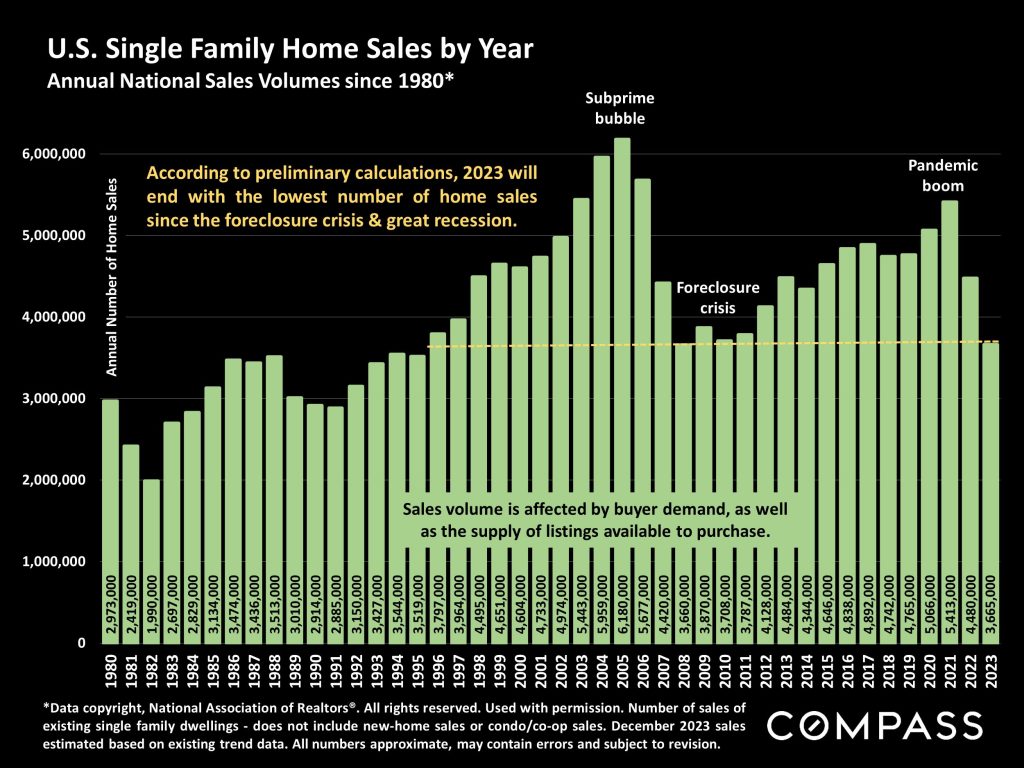

Home sales plunged in 2023, but if economic conditions continue to improve as currently forecast, both supply and demand should rise in 2024.

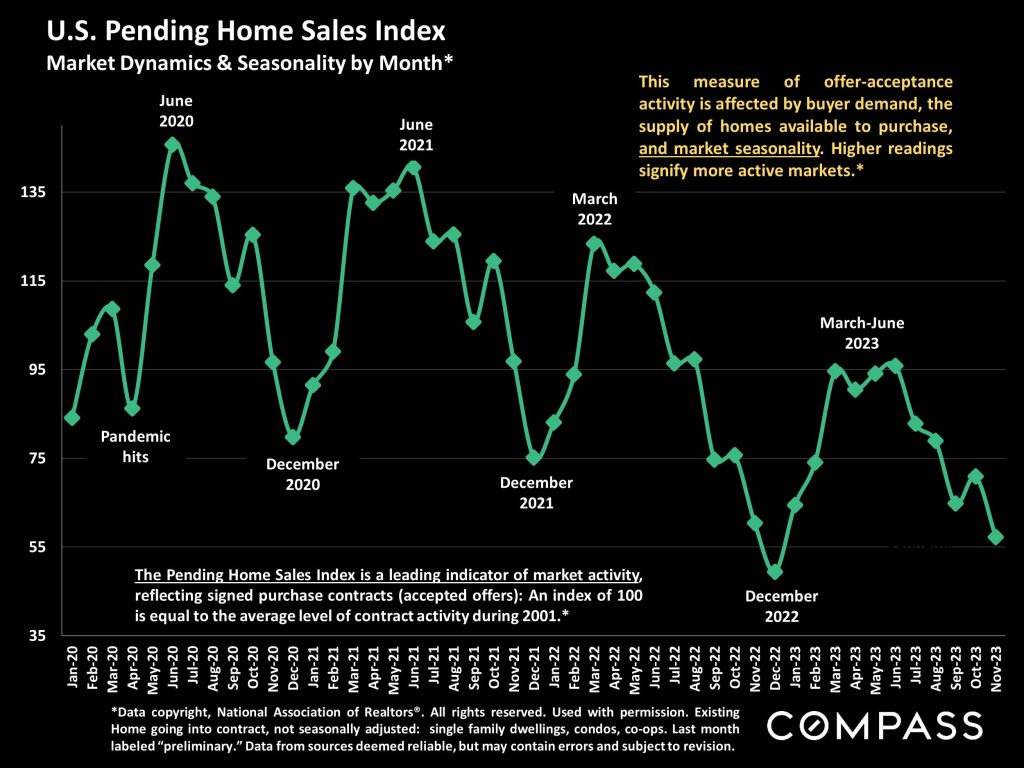

Monthly accepted-offer activity, seen below, highlights the effects of market seasonality. Activity usually picks up rapidly in the 1st quarter to peak in spring.

A long-term illustration of national median house sales prices – which defying expectations, saw a strong recovery in 2023 after the mid-2022 plunge.

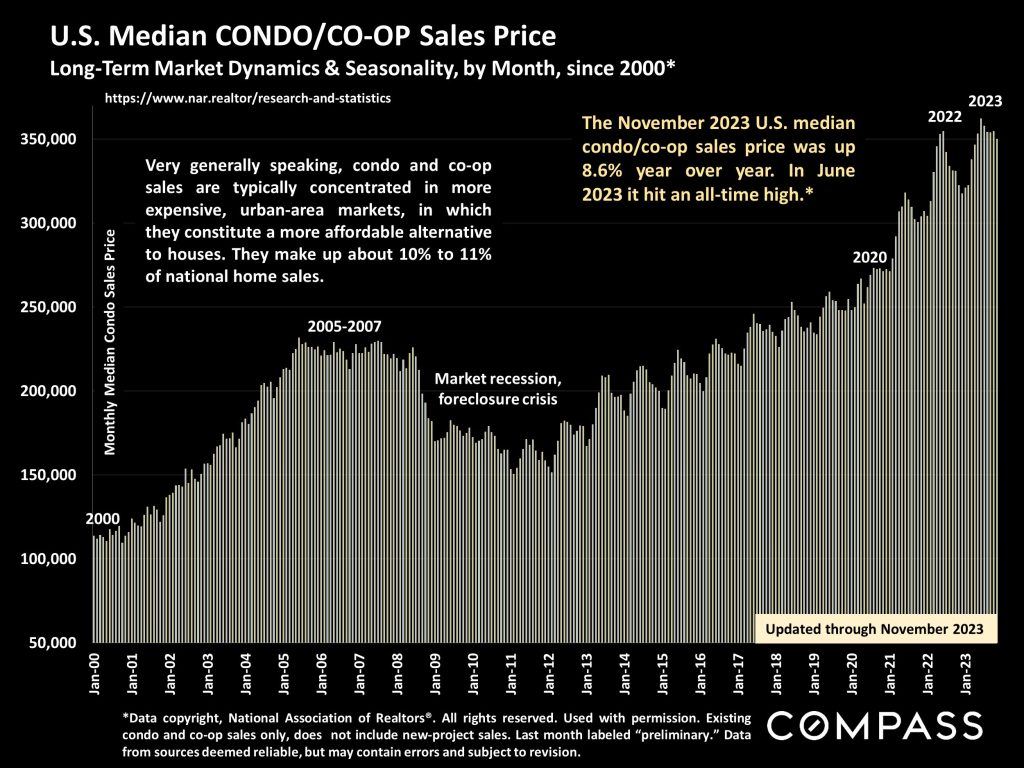

Perhaps due to their relative affordability, median prices of condos and co-ops rebounded even more than house prices to hit a new high last year.

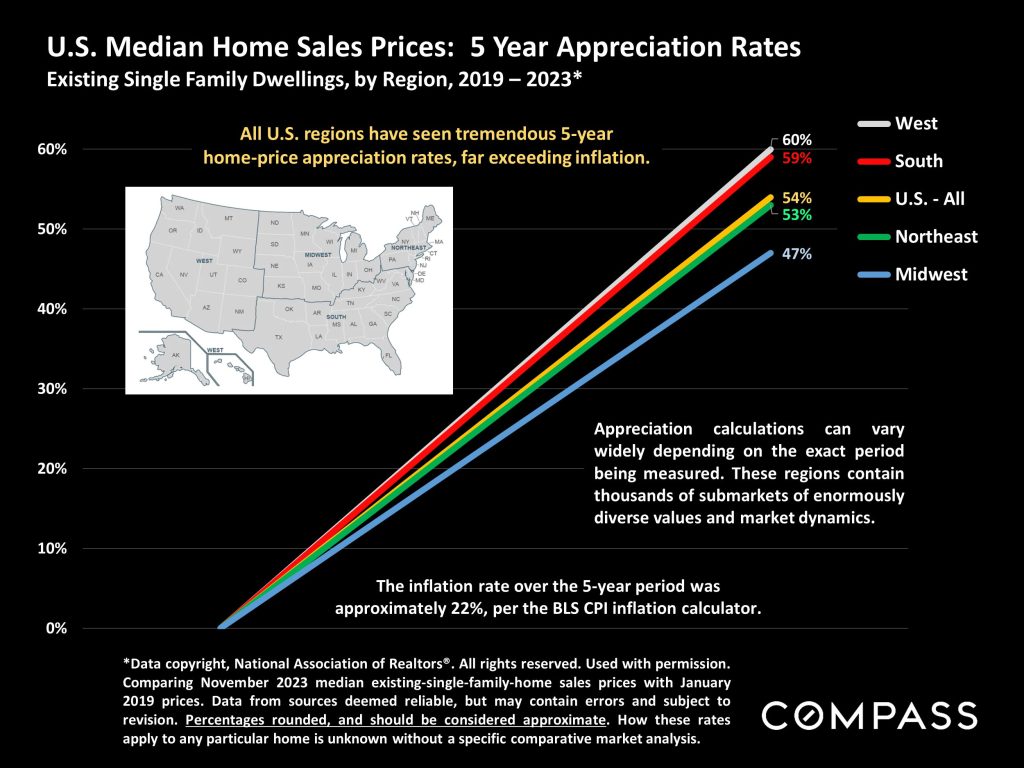

Across all national regions, there has been very substantial

home price appreciation over the past 5 years.

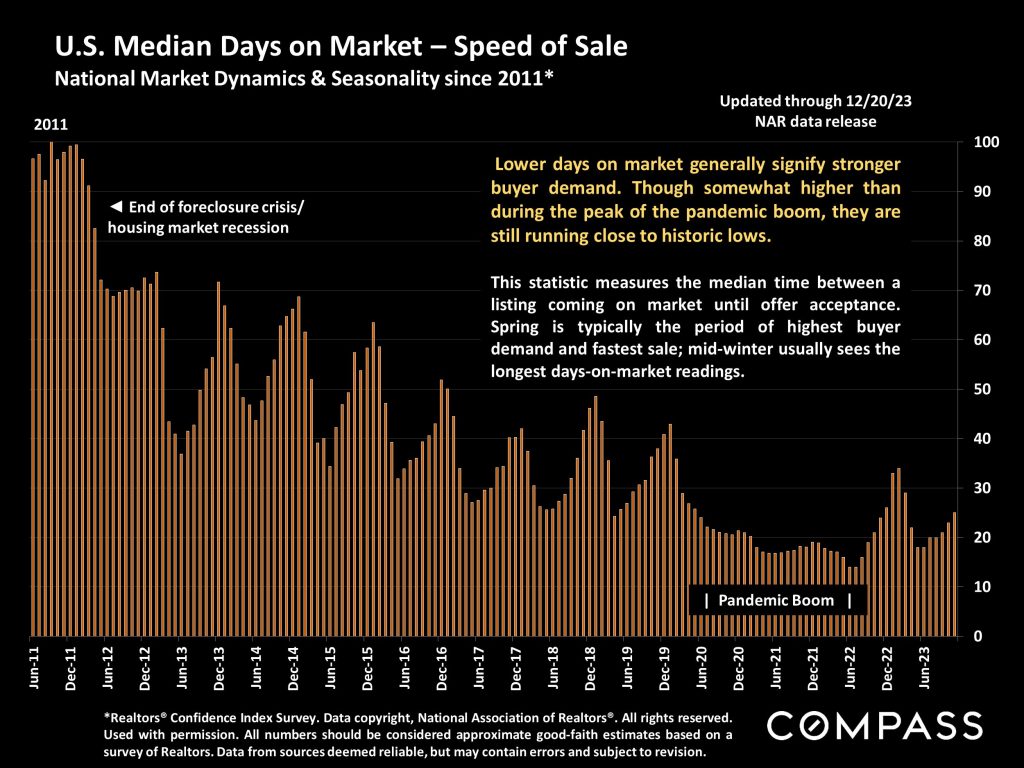

Speed of sale is mostly determined by the intensity of buyer demand as compared to supply. Median days on market remain very low by long-term standards.

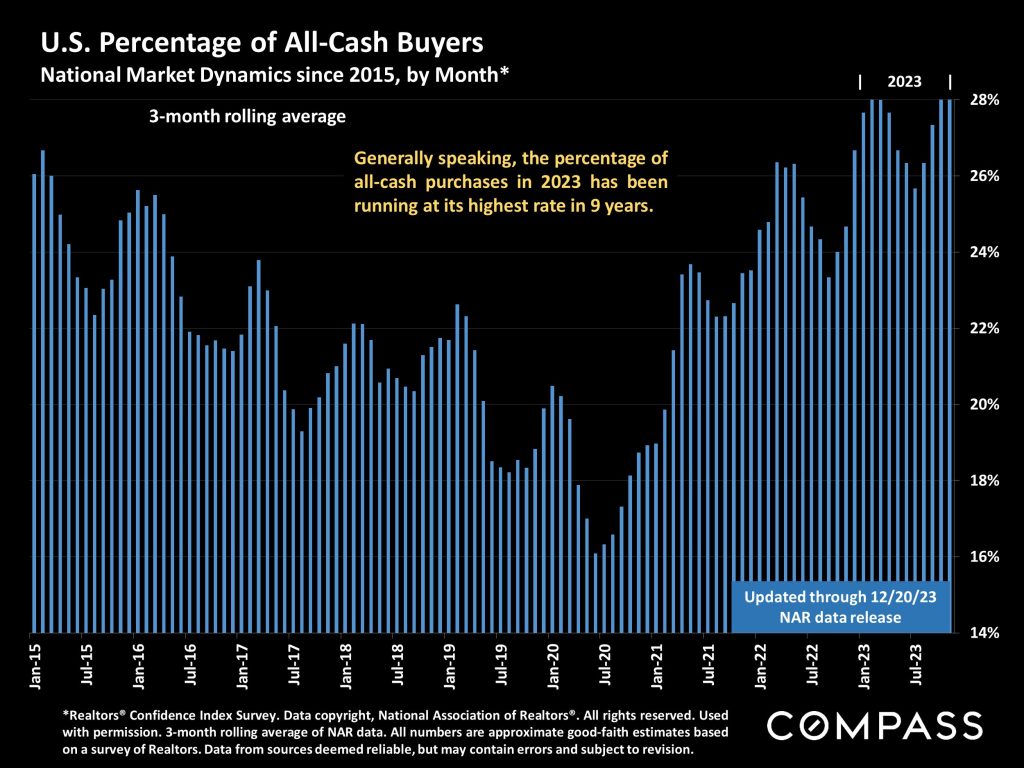

As interest rates rose, so did the percentage of all-cash buyers – who have played an increasing role in supporting demand and home prices.

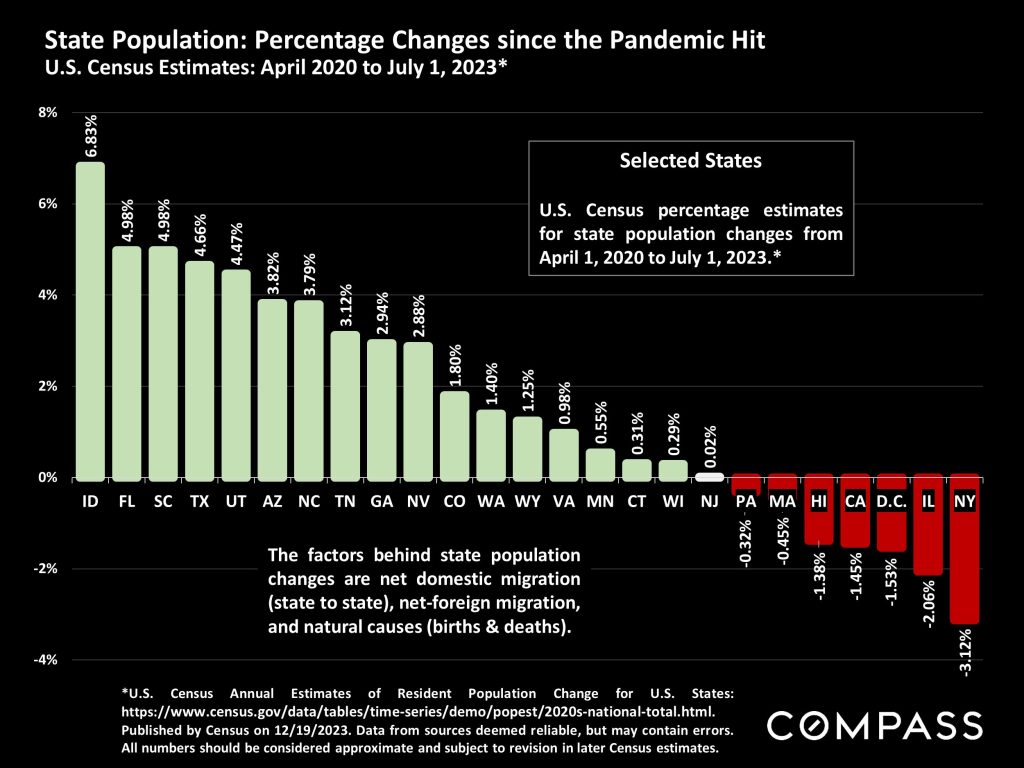

One of the biggest factors behind demand is population change, especially migration, which has been a particularly important issue since the pandemic.

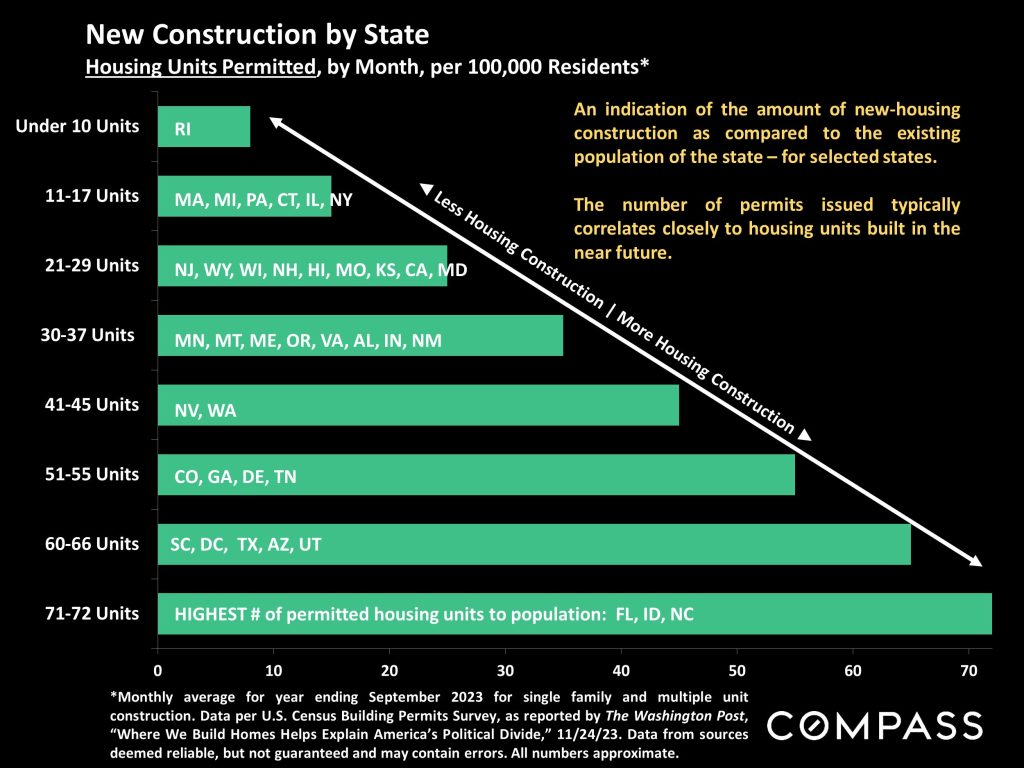

The rate of new home construction is a critical dynamic in both the supply of homes for sale and housing affordability. It varies widely by state.

Wishing you and yours a safe, happy, healthy and prosperous 2024!

| Please let us know if we can, in any way, be of assistance to you, or to your family, friends and colleagues. |