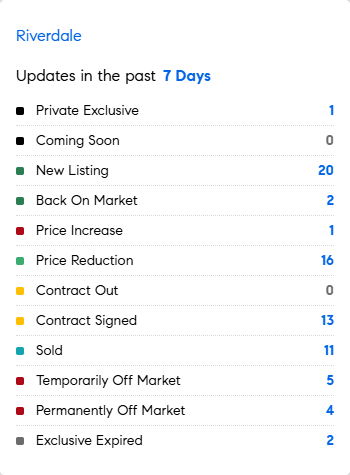

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 1/5/2026 – 1/12/2026

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

DID YOU KNOW?

* Aside from the 2020 pandemic year, 2025 saw the weakest US job growth in a decade. Hopefully, this improves in 2026 as A.I. adoption accelerates.

* Around 20% of respondents said they got five or less hours a night. A decade ago, it was 14%, and back in 1942 it was just 3%. (Gallup)

* Florida retirees are becoming much wealthier: In Collier County, which includes Naples, newcomers from New York, the top feeder state for that county, had average adjusted gross incomes of $401,000 while, for those from No. 2 Illinois, the average was $726,000. In Miami-Dade County, the share of million-dollar-plus single-family home sales jumped to 25% in 2025 through November, from 8% in 2019 (Miami Association of Realtors)

* Weary of ‘smart’ everything, Americans are craving stylish ‘analog rooms’ free of digital distractions—and designers are making them a growing trend. (WSJ)

* What was the most effective cure for high housing inflation? Intense construction in several areas around the US, and this cure accelerated between 2021-2025…..but because building anything takes so long, the impact of this is only now being felt in consumer rents that are seeing more incentives and price adjustments. (WSJ)

* Will (the super-high) Credit Card interest rates be capped at 10%? The US Government is considering a 1-year freeze. (somewhat akin to a rent-freeze or rent controls?) The 10-Year treasury eaked up a bit closer to 4.2%. (CNBC)

“If I had a dollar for every time I had a

client tell me ‘my smart music system

keeps dropping off’ or ‘I can’t log in.’ ”

– Christine Gachot, Interior Designer. tothe stars!

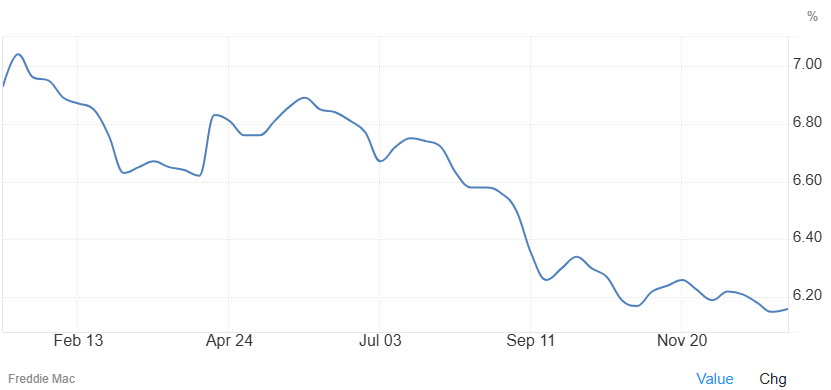

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage edged higher to 6.16% as of January 8th from the lowest level of 2025 of 6.15% in the previous week, according to data from Freddie Mac. “In the first full week of the new year, mortgage rates remained within a narrow range, hovering close to the 6% mark. The combination of solid economic growth and lower rates has led to improving momentum in for-sale residential demand, with purchase applications up over 20% from a year ago,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac