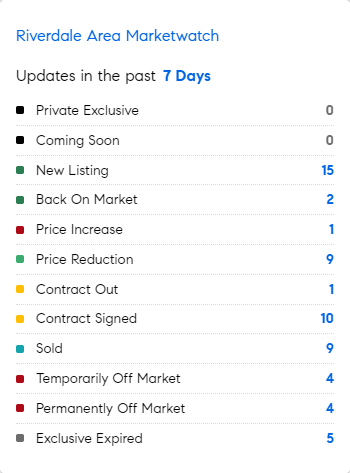

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 9/11/2023 – 9/18/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Singapore’s home sales fell last month to the lowest since January as demand slowed amid a lack of big launches. Purchases of new private apartments dropped to 394 units in August, figures from the Urban Redevelopment Authority. That’s down 72% from the previous month, when transactions climbed to a more than one-year high of 1,412 on the back of several major launches. Extremes are often followed by extremes. (BLOOMBERG)

* Weekend homes can be a wee bit self-indulgent. We reduced our strain on the planet by cutting our weekend commute from 110 miles down to 37 miles. By doing so we also cut costs…..we cut out 2 highway tolls….$21.10/ round trip….and with a hybrid getting 40 mpg compared to our prior 24 mpg car, we cut almost $27 from our weekly gas bill. That’s over $1,400 per year after tax savings, not to mention a drop of around 76% in weekly emissions.

* Surge pricing is seen everywhere from transportation of goods to Ubers and airlines. I hope as the consumer and governments attack agent commissions they too will encourage us to charge surge-pricing surcharges for our additional transportation costs?

* Hate to say ‘I told you so….” but here goes: many months ago I said that while rising prices and extreme wealth creation have an upside they also have a downside: social revolt. When Auto workers see their bosses wages and company profits soar while their wages remain stagnant, what usually follows is revolt and strikes. When rental rates soar, what usually follows? Government intervention. We are seeing multiple areas around the world initiate curbs on raising rents and evictions. Even Singapore – the seat of capitalism – is enacting government protections for excessive housing costs.

* A recent WSJ article speaks to planning for a 60-year career. Yup the days of a 40-year career are waning. And many who extend their careers beyond the expected are doing so by choice, not necessity.

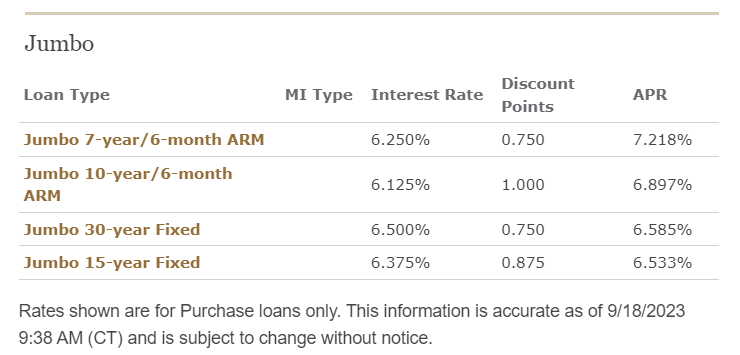

Courtesy of Stephen Lascher, Wells Fargo