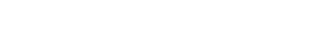

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 8/18/2025 – 8/25/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

DID YOU KNOW?

* Sales of existing US real estate to non-US citizens hit $56 billion in the year through March, up 33% from the same period the year before. Only about 2.5% of all existing homes are sold to foreign buyers in the US each year, a tiny minority of sales (yet many homesellers remain convinced their home will sell to a foreign oligarch/billionaire….. 😂🤔) (Bloomberg)

* According to the World Values Survey from the Policy Institute at King’s College London, 84% of people in the UK trust their neighbours, the 4th-highest levels of trust in the world behind Norway, Sweden and Egypt. In the US, 72% of respondents said they trusted those living next door. (FT)

* Manhattan’s (prime) office market is hot-hot again: borrowing tied exclusively to NY offices in the CMBS market is up to $11bn this year, with office financings in US securitized markets are at their highest level since 2021. Midtown Manhattan availability rates dropped to 15.5% in the second quarter from 18.2% a year earlier. Weekday use of the subway system is rebounding, with average paid rides nearing 4mn a day, still just 72% of pre-pandemic levels. (FT)

“You’d be surprised at how excited our

billionaire clients are when we get them a

$1,000 discount,”

– High End Travel Agent (NY TIMES)

* The highest U.S. poverty rates are concentrated in the South and Southwestern states. Louisiana leads at 18.9%, followed by New Mexico (18.5%), Mississippi (17.3%), Arkansas (15.8%), and West Virginia (15.3%). 11.4% of all Americans live below the poverty line, roughly the size of Canada’s entire population.

“Monday morning will come whether you

set the alarm or not….”

Mortgage Rate Updates:

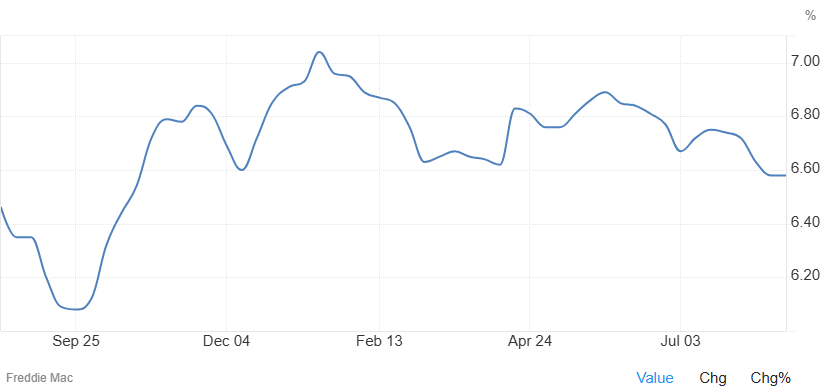

The average rate on a 30-year fixed mortgage backed by Freddie Mac held steady from the previous week at 6.58% as of August 21st, their lowest level since October. “The 30-year fixed-rate mortgage remained flat this week. Over the summer, rates have come down and purchase applications are outpacing 2024, though a number of homebuyers continue waiting on the sideline for rates to further decrease,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac