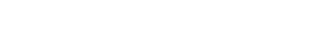

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 8/15/2023 – 8/21/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* A big chunk of activity we are seeing on the buying side in New York is being fueled by wealthy family transfers of wealth…..why?

This is nothing new, but in 2017 the tax cuts temporarily doubled the base amount individuals could give away without paying estate taxes to $10 million…For 2023, the combined gift- and estate-tax exemption is $12.92 million per individual, or $25.84 million per married couple, the amount you can give away during your life or at death tax-free.

These cuts are due to expire in 2026, pushing wealthy Americans to move fast. They gave away $182.6 billion in 2021, more than double the $75.2 billion the year before. Almost $100 billion of those gifts were made via trusts, some of which can last for generations. Another $14.8 billion went to charity. Those with a net worth over $10 million need to consider a range of moves before the tax cuts expire. The options range from straightforward gifts to heirs to setting up a complicated trust to protect wealth over generations.

Many wealthier families struggle with the effects inherited wealth has on their kids and often limited inheritance/gifting to things like education……and real estate! If the money is gifted to a trust and the value goes up $100 million by the time of death, that family would save $40 million in estate taxes alone, at the current 40% rate. That is just the federal tax savings! (WSJ)

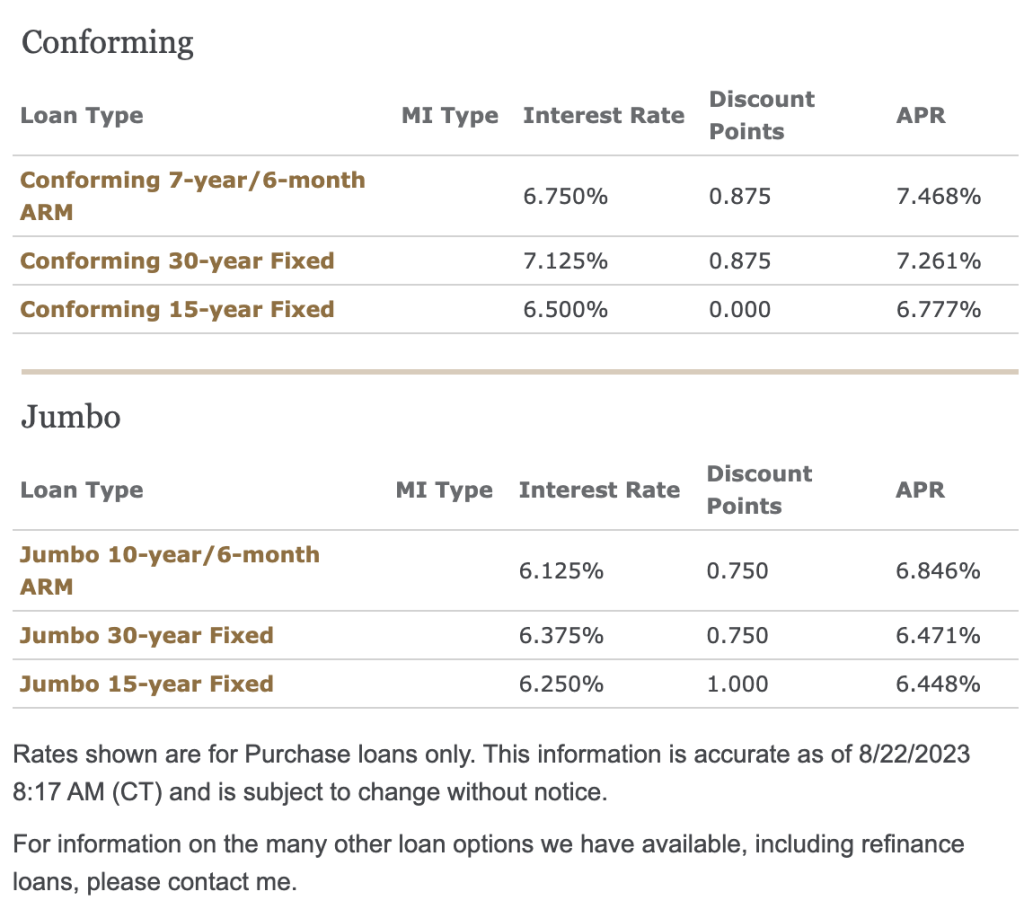

Courtesy of Melora Love, Wells Fargo