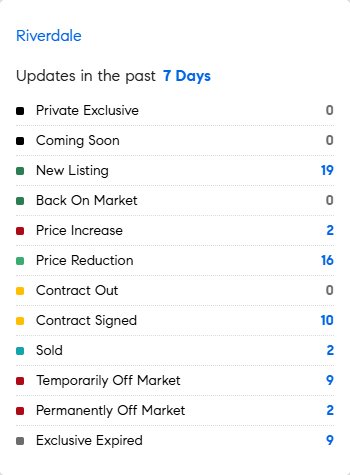

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/28/2025 – 8/4/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Do rent freezes work? This has been tested multiple times in New York City: During Bill de Blasio’s tenure as mayor, there were no rent increases on one-year leases in 2015, 2016 and 2020 — as well as 0% for the first 6 months and 1.5% for the last 6 in 2021……and the results? Rents in New York are higher than any other place in the US. When rents don’t rise in line with inflation, they can become economically unviable and decay: the average number of maintenance deficiencies in pre-1974 rent-stabilized buildings is up 45% since 2017. (Bloomberg)

* Consumer spending stagnated in the first half of this year, according to federal data issued last week. Are wealthier consumers becoming more thrifty to save more or are prices still rising too fast, or is it the fear of future inflation? Or is social media rewiring people’s awareness of saving for retirement earlier instead of spending on things you don’t need NOW? Are wages not rising enough to keep up with rising prices? Is this simply a result of mood/fear/uncertainty from market turbulence? Or media-generated fear? Interesting to watch this unfold…. on the other side, private jet travel is at an all time high. The UHNWI group has grown over 50% in recent years. (WSJ)

* In Silicon Valley, Mark Wong tells us at least 39 homes sold for $200k or more above asking. 23 sold for $400k or more above. One home had 96 offers….. (COMPASS

insights)

* On this day on August 4th in 1977 the first TRS-80 personal computer by Radio Shack was launched, in 1993 the Newton MessagePad by Apple was introduced, and in 1995 the eBay domain went online.

* The price of oil could dip as OPEC+ announced an increase of over half a million barrels a day in September….oil prices are down about 8% from a year ago. OPEC increased production earlier this year to meet pre-COVID levels after cutting production for several years. Reduced oil prices could offset inflationary forces.

* Is corporate profitability and performance facing turbulence? Here is a quote from this weekend’s Berkshire Hathaway’s quarterly earnings call:“It is reasonably possible there could be adverse consequences on most, if not all, of our operating businesses, as well as on our investments in equity securities, which could significantly affect our future results.”

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac fell by a meager 2 bps from the previous week to 6.72% as of July 31st, holding above its lowest since April of 6.67% seen four weeks ago. “The 30-year fixed-rate mortgage showed little movement, remaining within the same narrow range for the fourth consecutive week. Continued economic growth, along with moderating house prices and rising inventory, bodes well for buyers and sellers alike,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac