MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 7/14/2025 – 7/21/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Many people move to large cities to build careers. Then when retirement age comes along often they move to a cheaper and/or warmer area, or to be closer to family. Some move to lower taxed areas. Many retirees are moving out of New York City, Los Angeles, Washington D.C., Denver, San Jose, San Diego, Chicago, Oakland, Anchorage, Arlington, etc because of higher costs.These cities experienced the highest net loss of residents aged 60 and over in 2023. (CNBC)

* Remember when a mobile phone was for making calls? And a watch told the time? The Apple Watch offers a wide array of health-tracking features, including heart health monitoring, sleep tracking, fitness tracking, and more. It can detect irregular heart rhythms, take ECG readings, track sleep stages, and even monitor respiratory rate and wrist temperature while sleeping. Remember when real estate agents merely facilitated transactions?

* When a real estate agent buys a $200,000 car weighing 6,000lbs or more you may qualify for some big tax breaks: For tax years beginning in 2025, the maximum Section 179 deduction is $1,250,000. For SUVs weighing over 6,000lbs, the maximum Section 179 deduction is $31,300. Under the new bill, 100% bonus depreciation is permanently reinstated for qualified business assets placed in service after January 19, 2025: you can potentially deduct the entire remaining cost of the vehicle after the Section 179 deduction in the first year. To qualify for these deductions, the vehicle must be used for business purposes more than 50% of the time. The deductible amount is prorated based on the percentage of business use. Keep good records. Check with your accountant!

* While Americans on average say they’d need a net worth of $839,000 to feel financially comfortable, according to a recent survey from Charles Schwab, this varies considerably by location based on cost of living. Members of Gen Z say they’d be comfortable with less — just $329,000, on average. (CNBC)

* Those earning $250k in Miami will pay about $16,000 less in taxes than those earning the same in New York City. What does $16k buy you?

* While most have focused on the gains from the recently passed tax bill for the wealthy, few have mentioned that a typical family could potentially see up to $10,900 in additional take-home pay. Tipped workers could see their income boosted by up to $1,300 annually due to the tax exemption on tips. And hourly workers who work overtime could see their income increased by up to $1,400 per year due to the tax exemption on overtime pay premiums. Will these tax savings absorb the costs of tariffs that most estimate will have around 70% passed onto the consumer and will there be additional funds ‘left over’ to pay for other things and improve quality of life? Could this boost GDP sufficiently to offset growing debt?

Mortgage Rate Updates:

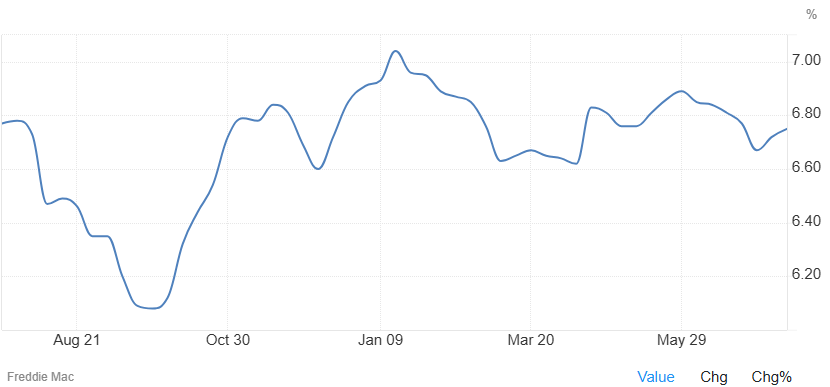

The average rate on a 30-year fixed mortgage backed by Freddie Mac rose by 3 bps from the previous week to 6.75% as of July 17th, rebounding further from its lowest since April of 6.67% seen two weeks ago. “The 30-year fixed-rate mortgage inched up this week and continues to stay within a narrow range under 7%. While overall affordability headwinds persist, rate stability coupled with moderately rising inventory may sway prospective buyers to act,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac