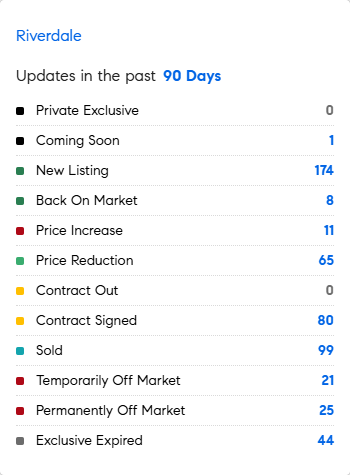

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 6/23/2025 – 6/30/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* A survey of some 200 agents specializing in luxury property found that ultra-wealthy buyers, defined as individuals worth at least $30 million, are still making big-ticket purchases despite trade war and recession fears. They are also driving a substantial rise in all-cash offers. Meanwhile, affluent but less wealthy buyers are more sensitive to interest rates and are acting more cautiously. (CNBC)

* In New York City, there were 26,310 vacant rent-stabilized apartments in 2023, down from 42,860 in 2021. These apartments remain vacant as low controlled rents make renovating them unviable. Imagine if all these entered the market…..combined with the significant increase in residential development, with nearly 71,000 residences either approved, under construction, or in the planning phase including a surge in office-to-residential conversions, reaching a record high of 70,700 units. (Building Design+Construction).

* Big money takeovers of private companies have driven mergers and acquisitions in the first half of 2025, with over half of the 10 largest deals announced involving a private target. The value of all deals globally has increased by almost 20% to $1.8 trillion, driven by transactions like Meta’s $14 billion-plus investment in Scale AI and other large deals. Despite ongoing geopolitical and trade turmoil, dealmakers are optimistic about the rest of 2025, with a strong second quarter and a more constructive market environment contributing to their confidence. (Bloomberg)

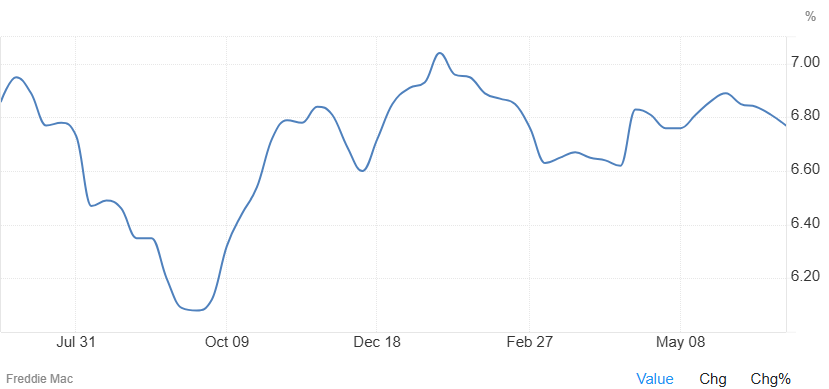

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac fell by 4 bps from the previous week to 6.77% as of June 26th, easing further from its highest level in nearly four months seen four weeks ago. “Borrowers should find comfort in the stability of mortgage rates, which have only fluctuated within a narrow 15-basis point range since mid-April. Although recent data show that home sales remain low, the resulting available inventory provides homebuyers with a wider range of options to consider when entering the market,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac