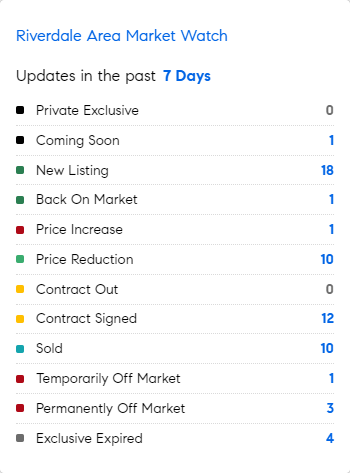

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 5/8/2023 – 5/15/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

After a decade of austerity and painful wage cuts, Greece is coming back, mostly driven by exporting: between 2010 and 2021, the country’s goods exports soared 90%, compared with 42% in the euro area as a whole. The other big driver of a recovery? During COVID, electronic payments became required, forcing previously untaxed cash economic transactions to be more visible and traceable. Yes, tax avoidance costs economies a lot! (FT)

Are we already in an EARNINGS recession? It appears so: the profits of S&P 500 companies are estimated to have dropped 3.7% on average in Q1 2023, compared to Q1 2022. While 78% of firms surpassed forecasts, that’s less impressive than it sounds, given analysts had slashed their expectations before the season kicked off. It was the second straight quarter of earnings declines for corporate America. Bearish earnings forecasts now center around the April to June period, for which a 7.3% profit slump is estimated. The pinch from higher interest rates and wilting consumer demand will extend into the third quarter of 2023. An earnings drop of more than 3 quarters was last seen in 2015 – 2016, when the Fed started its last interest rate hiking cycle. (Bloomberg)

One good thing about inflation? If you own an asset worth $1 million today, 4% annual inflation should escalate the value of that asset to about $1.48 million within 10 years…..even though your buying power will be about the same. (Better than devaluing cash, though, while paying rent?) If you have $1 million in debt today 4% inflation takes the ‘value’ – or buying power – of that $1 million closer to $520,000…..

In 2022 about 66% of the top executives at S&P 500 companies ended the year with smaller pay packages than they were awarded, on paper, due to equity market declines. Some 140 CEOs earned more money than expected, and at 46 companies the CEOs ended with at least double what boards planned to pay them for the year. CEO pay can fluctuate with market tides and other factors, something executives keenly understand. (WSJ)

Nearly 50% of U.S. consumers are eating three or more snacks a day, up 8% in the past 2 years. U.S. snack sales rose to $181 billion in 2022, up 11% from 2021. (Circana Group)

To better understand the Social Security funding challenge, consider the following: In 1950, there were more than 16 workers paying into Social Security per beneficiary. By 2000, there were barely 3½ workers per beneficiary. By 2035, the ratio will be 2.3 to 1, and that number will fall further in the future. The U.S. population is aging rapidly. Beneficiaries are living longer, while low fertility rates mean that fewer people have been entering the labor force over time. There are few solutions, including:

1. higher birth rates (unlikely)

2. more immigration/workers paying taxes

3. raised retirement (likely….if France can, then…..)

4. higher taxes…..

On December 31, 2021, ANYWHERE (owner of Century 21, Sotheby’s, Coldwell Banker, Better Homes and Gardens, Corcoran, etc) had $743 million in cash……as of Q1 2023 – just 15 months later – that number is down 83% ($617 million) to $126 million. Did you read that anywhere (no pun intended!)? This is no way a critique of our colleagues at Anywhere: but it is a critique of the press who obsessively focuses on all things COMPASS…..oh, I forgot….THANK YOU for all the attention! Obviously we are rating’s PLATINUM!

While the number of web visits on Zillow and Streeteasy declined slightly, Realtor.com’s web visits rose in April 2023. (Similarweb)

Of the 5 largest brokerages in the US by sales volume in 2022, COMPASS agents averaged $8.07 million per agent, ANYWHERE (Century 21, Sotheby’s, Coldwell Banker, Corcoran, etc) and Home Services (Berkshire Hathaway, Houlihan Lawrence, etc) each averaged about $3,71 million per agent, less than half of COMPASS, EXP came in at $2,15 million, and Douglas Elliman at $6,2 million, 23% lower than COMPASS agents. CONGRATULATIONS to all at Compass.

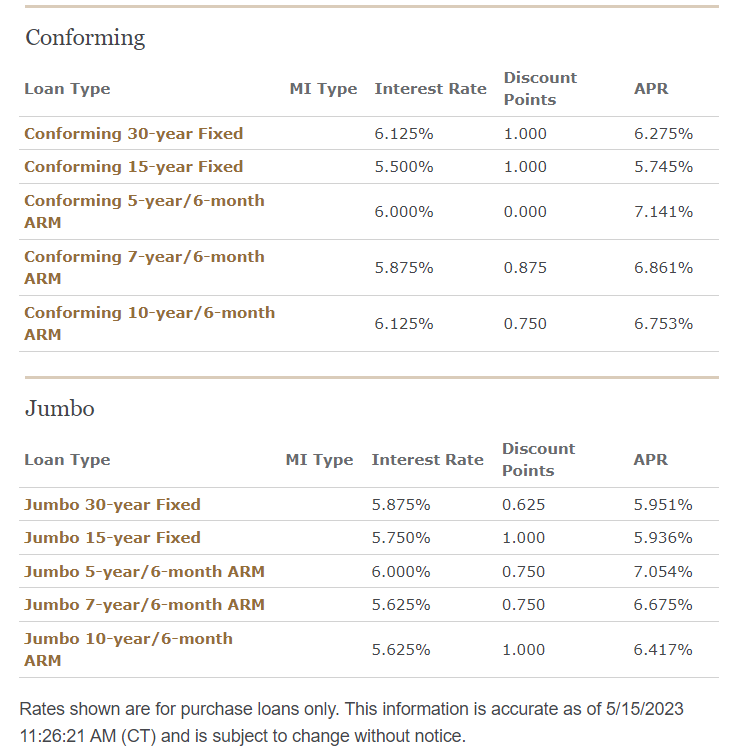

Courtesy of Melora Love, Wells Fargo