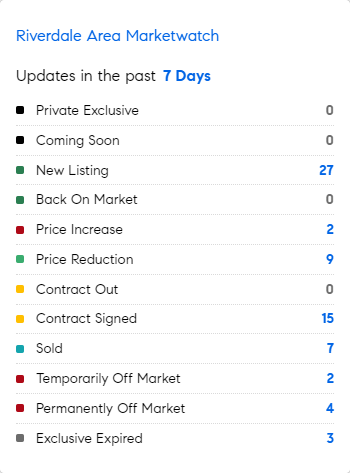

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 4/8/2024 – 4/15/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* It is tax filing day today….don’t forget!

* Let’s start today with some really good news…..Nationwide, homicides dropped around 20% in 133 cities from the beginning of the year through the end of March compared with the same period in 2023. Philadelphia (down 35%), Columbus (down 58%!) and San Antonio (down 50%) saw the biggest number drops. Boston saw an 82% decline! New York was down 16%, Miami-Dade and Chicago were down 9%. (WSJ)

* These are the 14 USA states where homes are most affordable, based on the annual income needed to cover homeownership costs without spending more than 28% on housing.

Mississippi: $63,043

Ohio: $64,071

Arkansas: $64,714

Indiana: $65,143

Kentucky: $65,186

Iowa: $65,314

Oklahoma: $65,443

Michigan: $66,343

Missouri: $66,986

Louisiana: $67,886

Alabama: $69,514

Kansas: $72,343

North Dakota: $73,414

West Virginia: $74,957.

(CNBC)

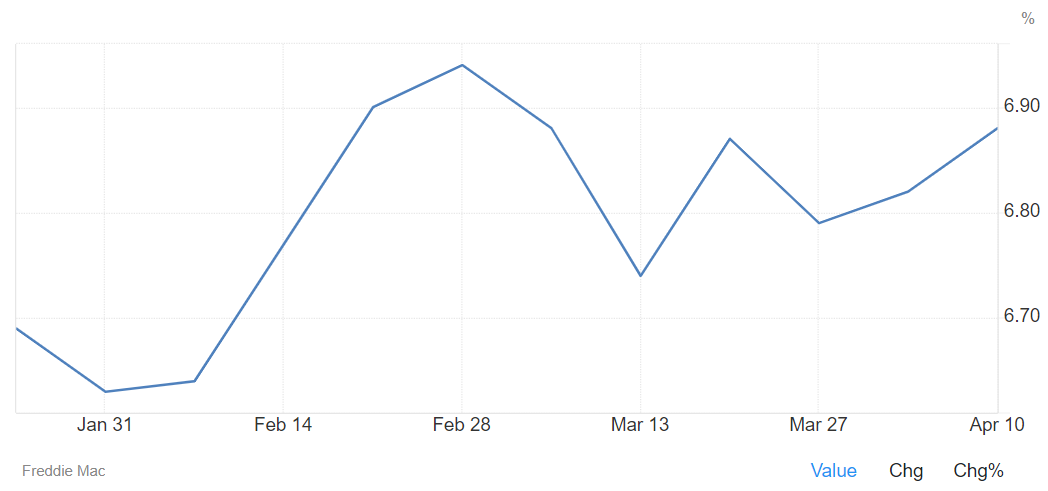

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was at 6.88% as of April 19th, edging 6bps higher from the previous week to the highest level in one month, in line with the increase in long-dated Treasury yields in the period. In the corresponding period of the previous year, the average rate on a 30-year fixed mortgage was 6.27%. “Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path,” said Sam Khater, Freddie Mac’s Chief Economist. “While newly released inflation data from March continues to show a trend of very little movement, the financial market’s reaction paints a far different economic picture. Since inflation decelerated from 9% to 3% between June 2022 and June 2023, the annual growth rate of inflation has remained effectively flat, ranging from 3.1% to 3.7% and averaging 3.3%. The March estimate of 3.5% annual growth is in the middle of that range.”.

Source: Freddie Mac