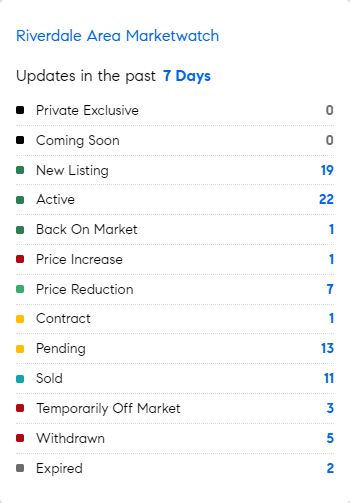

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 4/22/2024 – 4/29/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Starting conversations can be tough for most: Some have learned that no one really cares what you say. For all the anxiety and nervousness with which one approaches interactions, most people are too preoccupied with their own fears and insecurities to much consider yours. Unless you’re desperately rude or highly precocious, people don’t tend to judge. Most of the time we’re pretty grateful that someone is prepared to talk to us at all. Everyone is awkward. Few people are natural (and even fewer, gifted) raconteurs. Asking questions is often best! (FT)

* Cities that boast robust financial infrastructure, vibrant entrepreneurial ecosystems, and lucrative real estate markets, are always attractive destinations for the ultra-wealthy. Speaking about New York, Los Angeles, Beijing, San Francisco, Tiger 8 centimillionaire portfolios often feature very strong, stable pieces of real estate: These wealthy individuals gravitate toward “trophy asset” Class A properties, or investment-grade assets that typically were built within the last 15 years. Real estate investments typically represent 27% of these individuals’ portfolios.

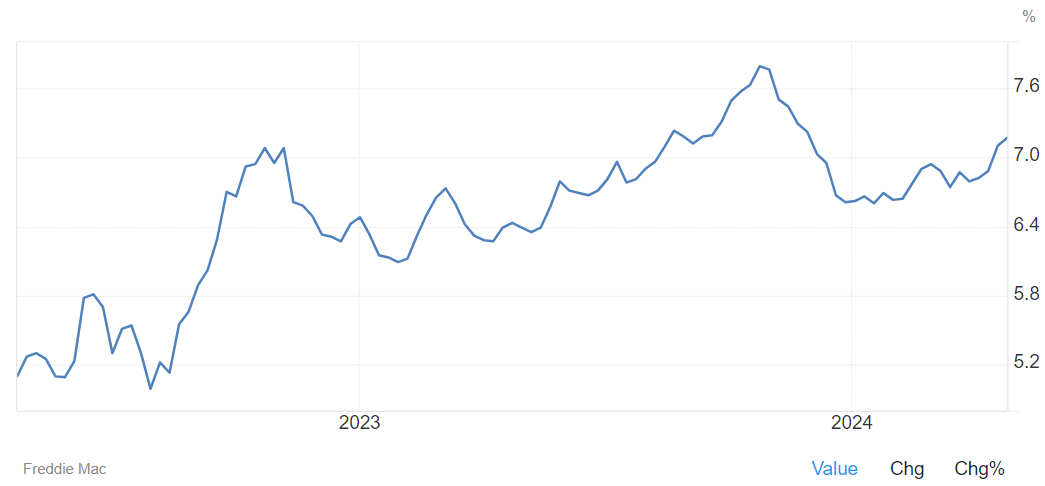

Mortgage Rate Updates

The average rate for a 30-year fixed mortgage surged to 7.17% as of April 25th, rising 7 basis points from the previous week to its highest level since November, according to data from Freddie Mac. This increase aligns with the sharp rise in long-dated Treasury yields amid growing expectations for a more hawkish stance from the Federal Reserve. In the same period last year, the average rate for a 30-year fixed mortgage was 6.43%. “Mortgage rates continued their ascent this week,” stated Sam Khater, Freddie Mac’s Chief Economist. “Despite rates climbing more than half a percent since the start of the year, demand for home purchases remains robust. With rates expected to stay elevated for an extended period, many homebuyers are adapting, as evidenced by the significant increase in sales of newly built homes reported this week, marking the largest rise since December 2022.”.

Source: Freddie Mac