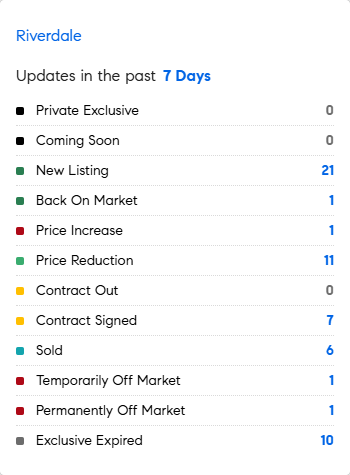

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 2/24/2025 – 3/3/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* How many people in your state are employed by the government? As of 2022, Wyoming, Alaska, Kansas, Nebraska, North Dakota, Mississippi and New York have the highest number of government employees per capita…..all above 600 per 10,000 population.

* What is a NEET? When deciding where to live it would be wise to evaluate youth employment: unemployed youth is never healthy for a society. In the UK 987,000 16- to 24-year-olds are not in education, employment or training. NEETs become angry…. In 2022, around 13% of Americans aged 18–24 were not employed or enrolled in school, down from 17% in 2012 after the Great Recession.

* Many in the crypto community feel strongly that a Strategic US Crypto Reserve should hold only bitcoin as it’s the most battle tested and decentralized of the crypto networks. The inclusion of other coins could invite the government to pick winners and losers in the crypto market. Another faction rejects the idea of a U.S. reserve of any cryptocurrencies, as it could potentially undermine the status of the dollar and be easily undone by a future administration. Should the U.S. government, or any government, own the most decentralized asset ever? Could this put too much power in the hands of the federal government, which is always in a 4-year, or even 2-year, cycle? (CNBC)

* Some like collecting Birkin bags which require a huge closet, but what size storage is needed if you collect cars?….or a big RV? LOTS more, which may make the Birkin’s cheap by comparison? Some areas around the US are struggling with neighbors building huge garages and car barns…..and some zoning does not allow for this when attached to the house. Underground garages that house 30 cars are popping up more frequently…. (WSJ)

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage backed by Freddie Mac eased to 6.76% as of February 27th, marking its sixth consecutive weekly decline from an eight-month high of 7.04%. The drop aligned with falling long-term Treasury yields, as weak economic data—particularly a fresh contraction in the services sector—reinforced expectations of Fed rate cuts, while escalating trade tensions drove safe-haven demand for bonds. “This week, mortgage rates decreased to their lowest level in over two months. The drop in mortgage rates, combined with modestly improving inventory, is an encouraging sign for consumers in the market to buy a home,” said Sam Khater, Freddie Mac’s Chief Economist.

Source: Freddie Mac