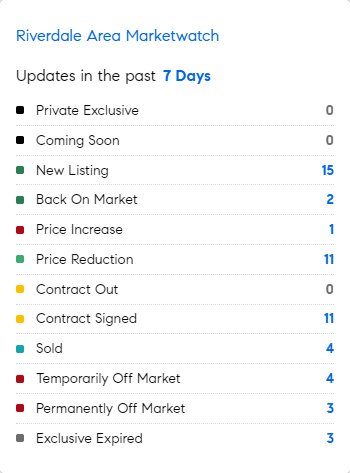

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 2/19/2024 – 2/26/2024

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Is a cutting edge chip-making factory coming to your area? Semiconductor manufacturing projects in Arizona, Texas, New York and Ohio will be announced in the coming weeks from Intel, Taiwan Semiconductor Manufacturing, Samsung and Micron who have all submitted applications for the government to cover a portion of the billions of dollars it costs to build these factories. (WSJ)

* Homes under 500sf are not taking over anytime soon and are less than 1% of the new homes built in the US, but home dimensions are shrinking in areas to fuel affordability. A 12ft x 14ft primary bedroom can accommodate almost everything a 14ft x 18ft bedroom – a third smaller – does. If construction costs $300 per square foot, that’s $25,000 saved already… (NYT)

* San Francisco is once again experiencing a tech revival. Entrepreneurs and investors are flocking back to the city, which is undergoing a boom in artificial intelligence. Silicon Valley leaders are getting involved in local politics, flooding city ballot measures and campaigns with tech money to make the city safer for families and businesses. Investors are also pushing startups to return to the Bay Area and bring their employees back into the office. Investment in Bay Area startups dropped 12% to $63.4 billion in 2023. By contrast, funding volumes for Austin, Texas, and Los Angeles, two smaller tech hubs, dropped 27% and 42%, respectively. In Miami, venture investment plunged 70% to $2 billion in 2023. (WSJ)

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was 6.77% as of February 15th 2024, up from last week when it averaged 6.64%, consistent with the recent upsurge in benchmark long-dated Treasury yields driven by robust US economic data. One year ago, the average rate on a 30-year fixed mortgage was 6.32%. “On the heels of consumer prices rising more than expected, mortgage rates increased this week,” said Sam Khater, Freddie Mac’s Chief Economist. “The economy has been performing well so far this year and rates may stay higher for longer, potentially slowing the spring homebuying season. According to our data, mortgage applications to buy a home so far in 2024 are down in more than half of all states compared to a year earlier.”

Source: Freddie Mac