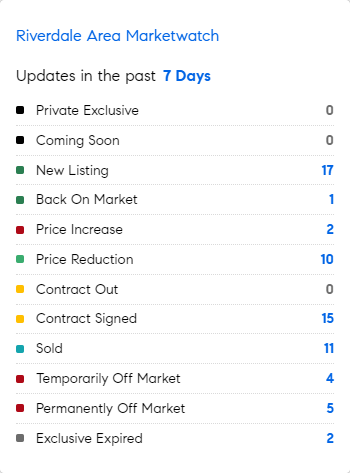

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 11/6/2023 – 11/13/2023

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

* Alabama State’s Fortified Program – grants for home resiliency improvements – has been a driving force keeping Alabama’s insurance market in check. Alabama leads the nation in building homes and roofs that can withstand high winds from hurricanes via a set of resilience standards developed by the Insurance Institute for Business & Home Safety, or IBHS, a research group funded by insurers. Government mandated state and local building codes include elements such as sealing roof decks, installing impact-resistant windows and doors, and tightly fastening roofs to walls. The average premium was $1,243 in 2021, the most recent year for which data is available, compared with $1,396 in 2015. (WSJ)

* Too Big to fail? The four biggest US lenders – JPMorgan Chase, Bank of America, Wells Fargo and Citigroup – with more than $1 trillion in assets each grabbed almost half of all banking profits in the third quarter, highlighting their growing advantage in the new era of higher-for-longer interest rates. Earnings were up 23%. All four paid less than 2% interest on accounts….. Regional banks pay 3%-plus! (PS: Ally pays 4.25%) As of June 30, 2023, there were 4,071 commercial banks and 574 savings and loan associations in the U.S. insured by the FDIC with $23.5 trillion in assets. (FT)

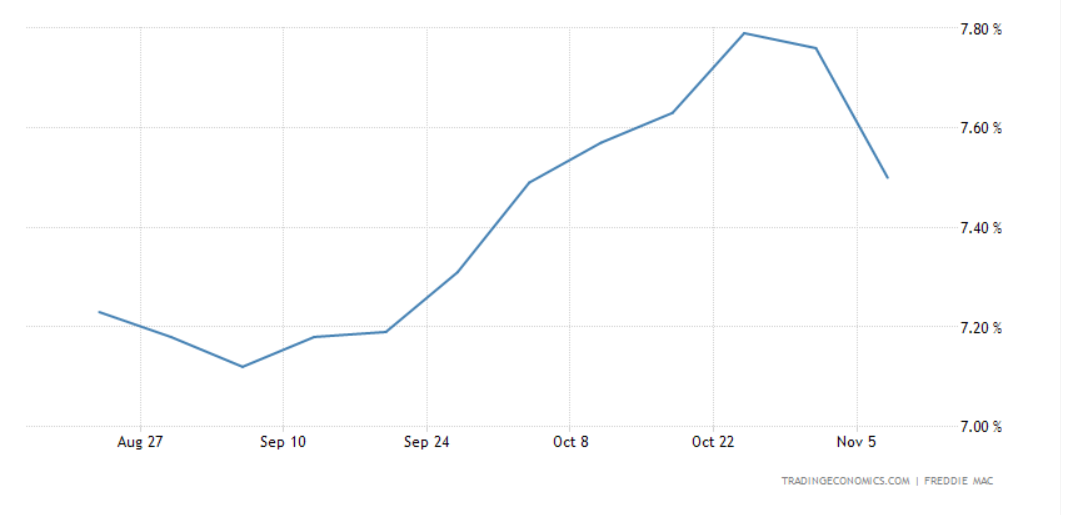

Mortgage Rate Updates

The average rate on a 30-year fixed mortgage was 7.5% as of November 8th, declining by 26bps from the previous week and 29bps below the 23-year high from the end of October. The result was in line with the sharp pullback in long-dated Treasury yields as markets pared expectations on how long the Federal Reserve will hold its terminal rate. One year ago, the average rate on the 30-year fixed mortgage was 7.08%. “As Treasury yields decline, the 30-year fixed-rate mortgage dropped a quarter of a percent, the largest one-week decrease since last November,” said Sam Khater, Freddie Mac’s Chief Economist. “Incoming data show that household debt continues to rise, primarily due to mortgage, credit card and student loan balances. Many consumers are feeling strained by the high cost of living, so unless mortgage rates decrease significantly, the housing market will remain stagnant.”.

Source: Freddie Mac