June 2025 National Real Estate Insights

After a volatile spring, the housing market is beginning to show signs of stabilization. Economic uncertainty and consumer confidence are improving, inventory is climbing, and sales activity is gradually picking up—though affordability challenges remain for many buyers. Market dynamics continue to shift between property types and price points, with pricing strategy and preparation becoming more important than ever.

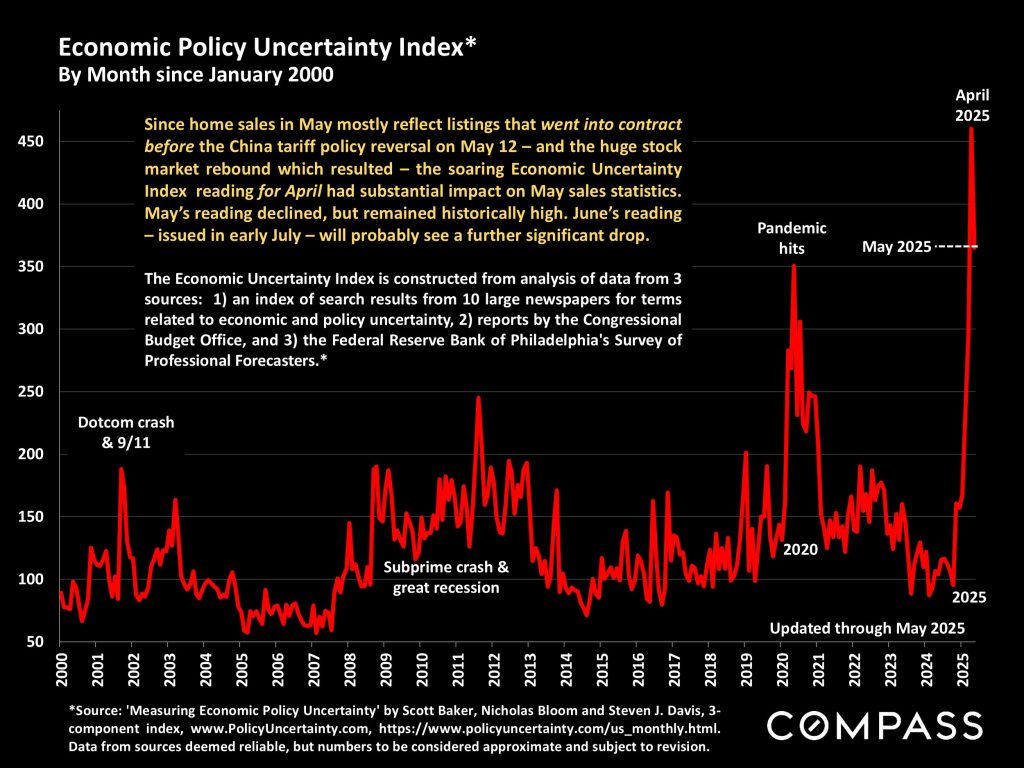

“Economic uncertainty” soared in April, which affected the number of listings going into contract, which affected closed sales in May. Happily, the uncertainty index reading fell significantly in May and is expected to fall much further in the next reading coming out in early July.

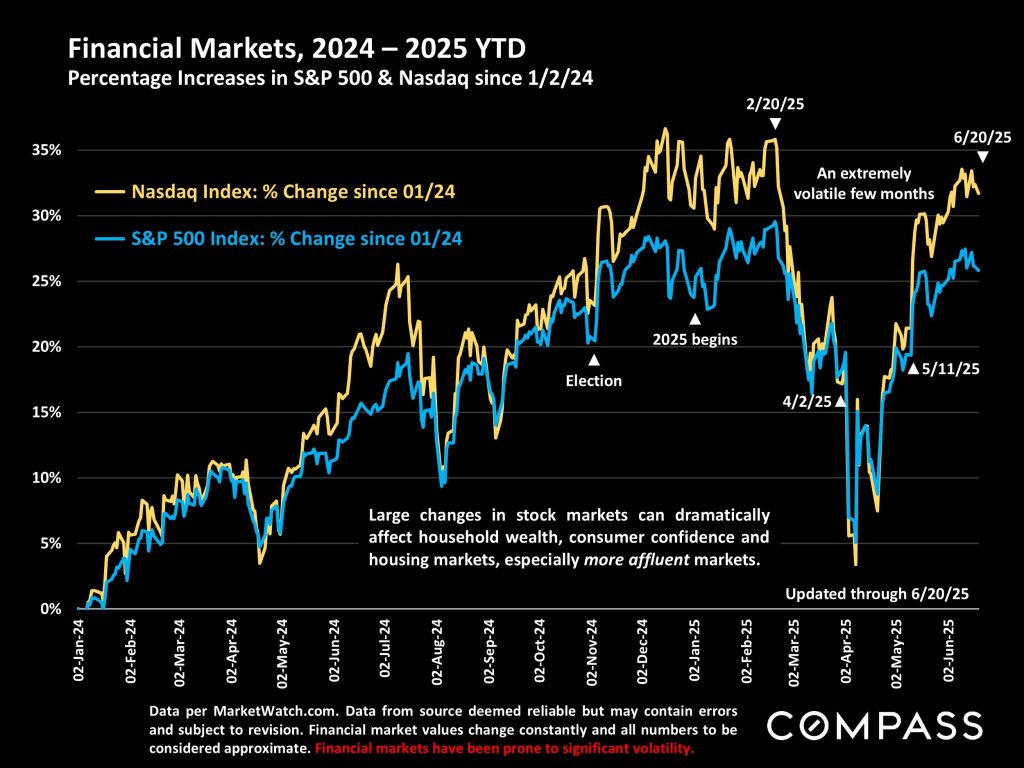

The enormous decline in stock markets in March and April was followed by an enormous rebound in May, which along with the positive changes in economic uncertainty and consumer confidence, may show up in June sales activity.

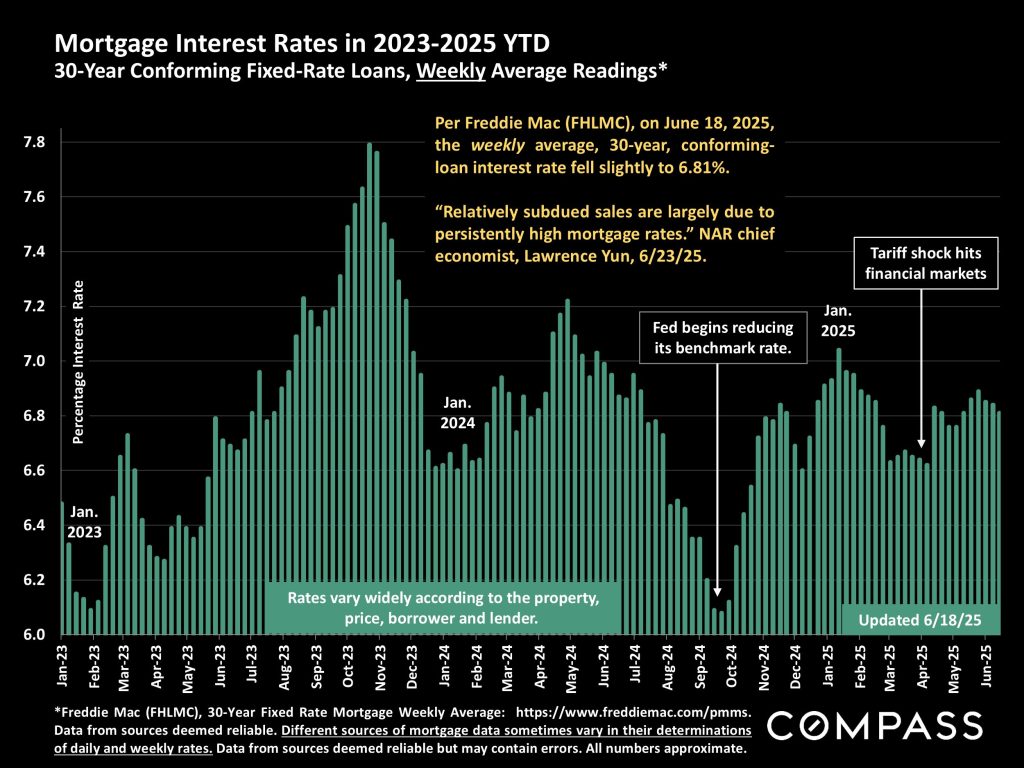

After rising with the initial tariff shock, mortgage rates have been relatively stable in the last 2 months, running a little below 7%: Somewhat lower than last year at this time, but too high to significantly boost buyer demand this spring.

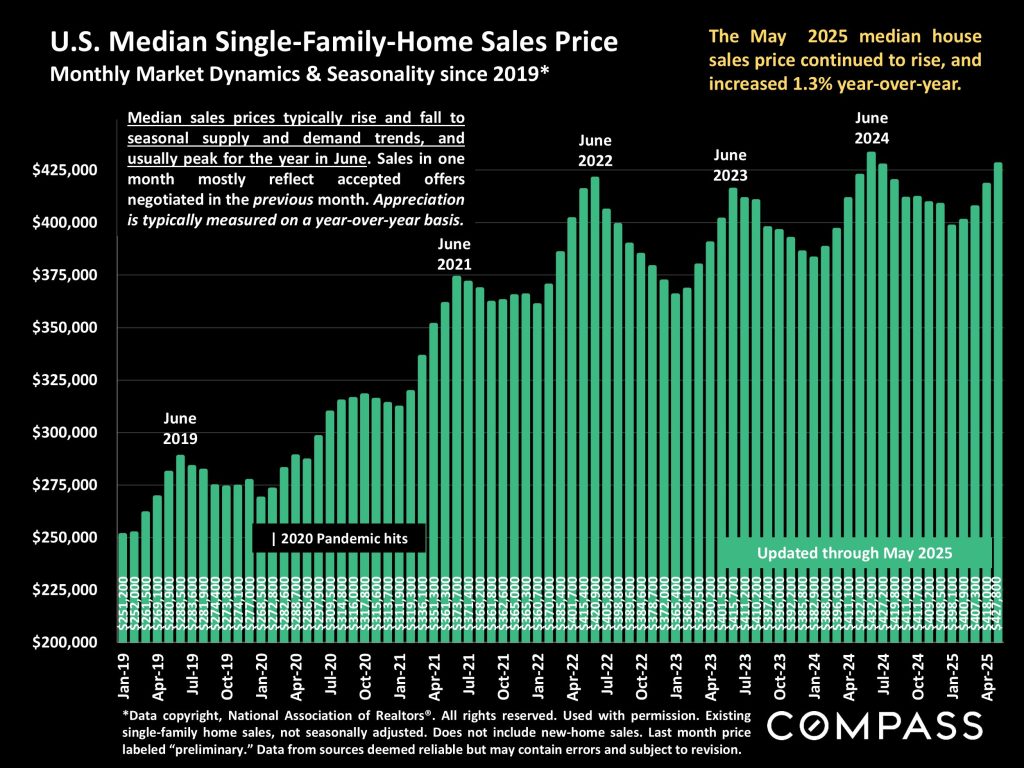

Median sales prices continued to rise in May. More often than not, they peak for the calendar year in June, due to both buyer demand and the typical increase of luxury home sales in spring. The chart below pertains to the median house sales price, but the median condo/co-op price also increased slightly year over year. Median sales prices can be affected by other factors besides changes in fair market value.

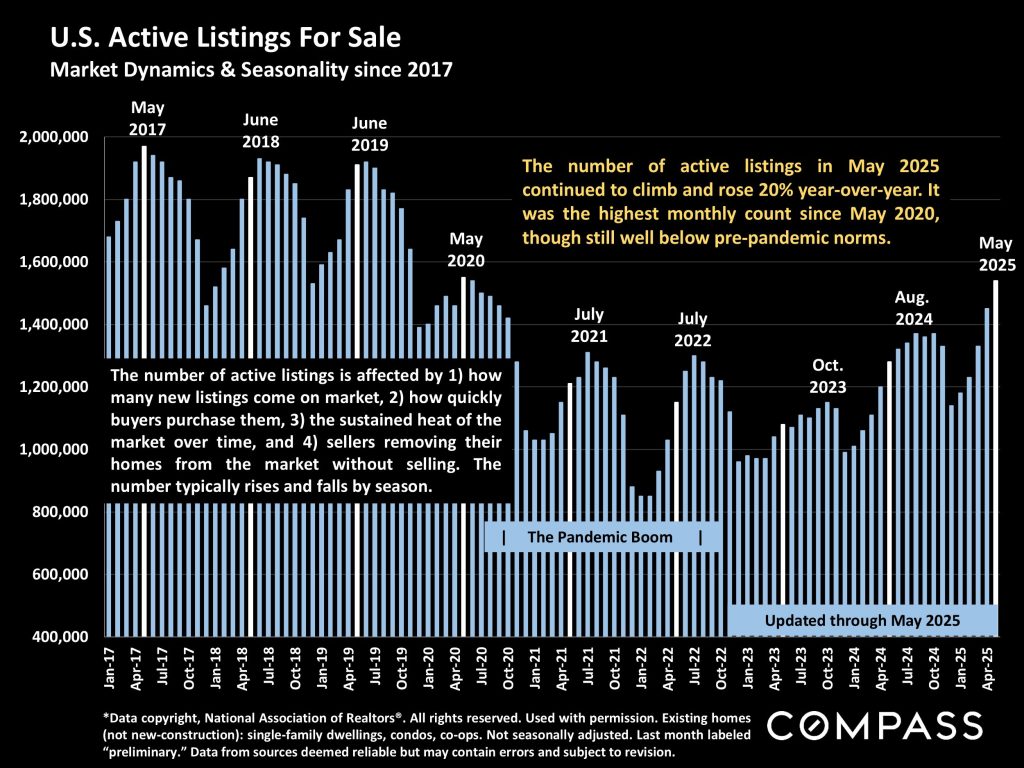

The number of active listings for sale increased both month over month and year over year, hitting its highest count in 5 years. On current trends, it will probably continue to rise in coming months. This is affecting the balance of power between buyers and sellers, though much depends on the specific listing.

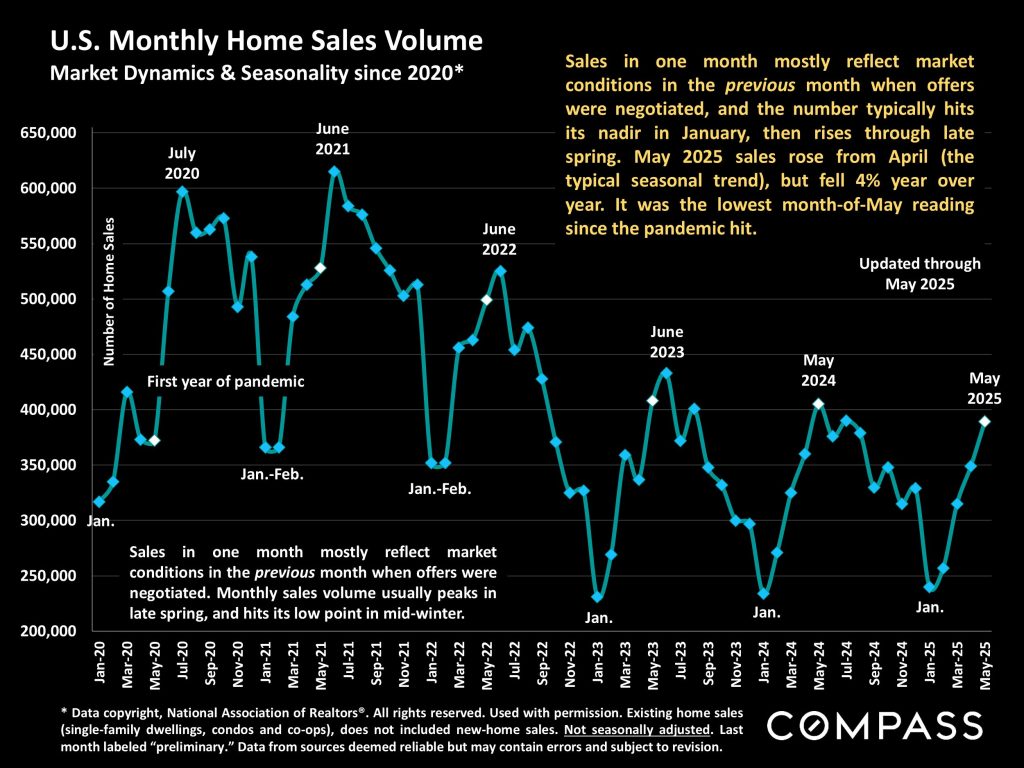

The number of the sales in May increased from April, such as typically occurs, but affected by factors already discussed, it declined from May 2024. Again, May’s sales mostly reflect market conditions in April when financial markets and consumer confidence crashed. Both have rebounded since.

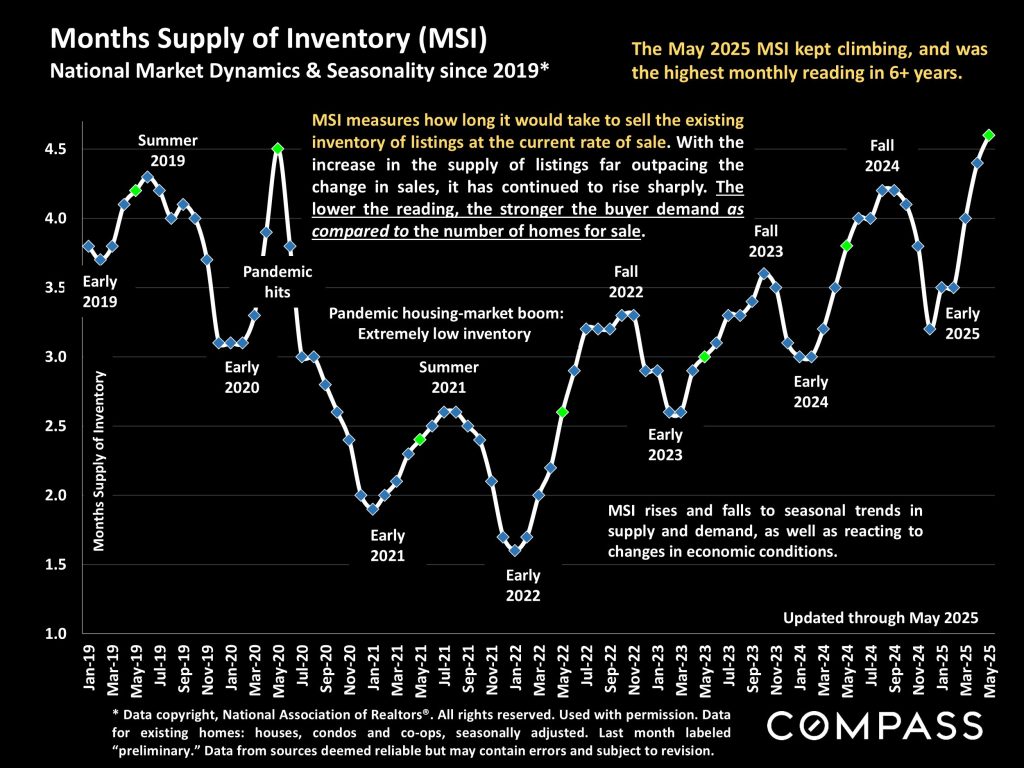

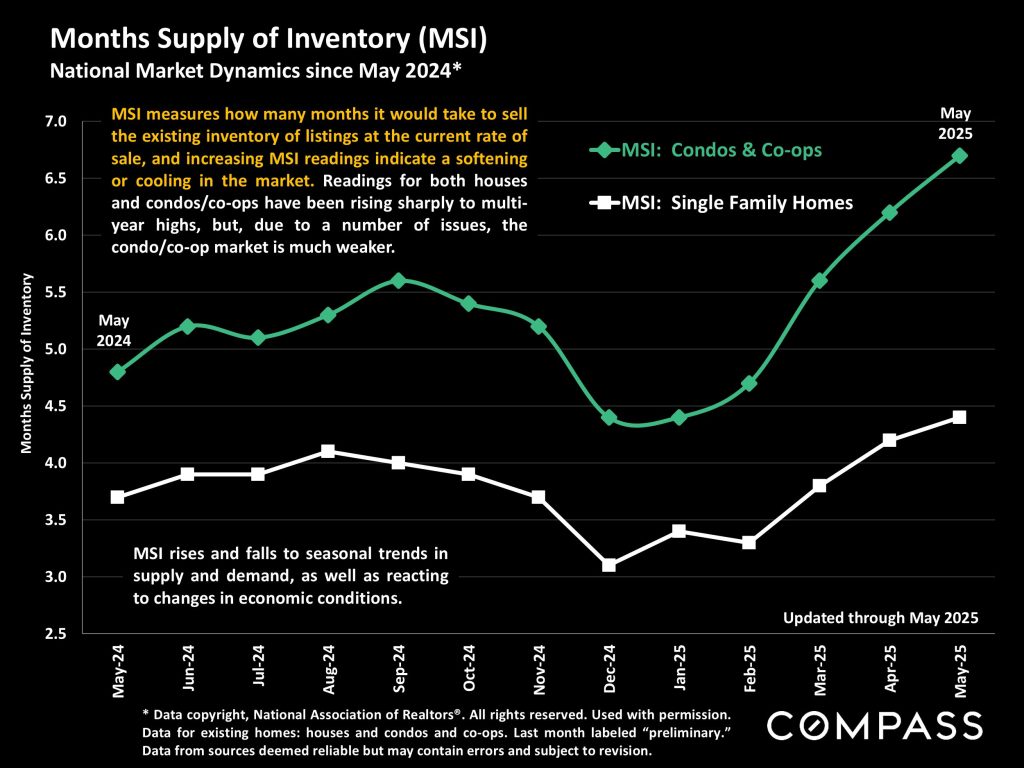

Months-supply-of-inventory (MSI) is a measurement of buyer demand vs. the supply of homes available to purchase: The higher the reading, the softer the market. MSI for all homes hit its highest reading in over 6 years (first chart below). However, as illustrated in the second chart, the condo/co-op market has been running much weaker than the house market: Insurance and construction upgrade issues have hurt condo/co-op sales in many regions.

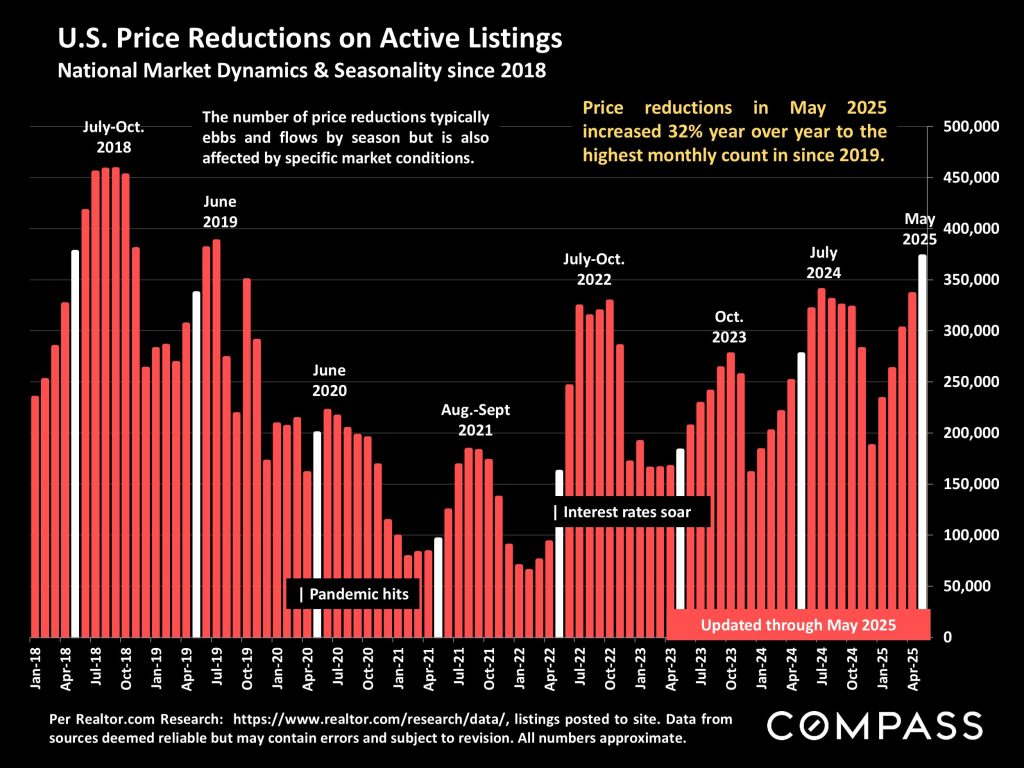

With the year-over-year number of listings soaring and the number of sales declining, price reductions reached their highest monthly count since 2019. Correct pricing, preparation and marketing are always important, but in softening markets, they become an imperative for sellers. Buyers should keep a close eye on properties undergoing price reductions: They can offer excellent opportunities to negotiate very good deals.

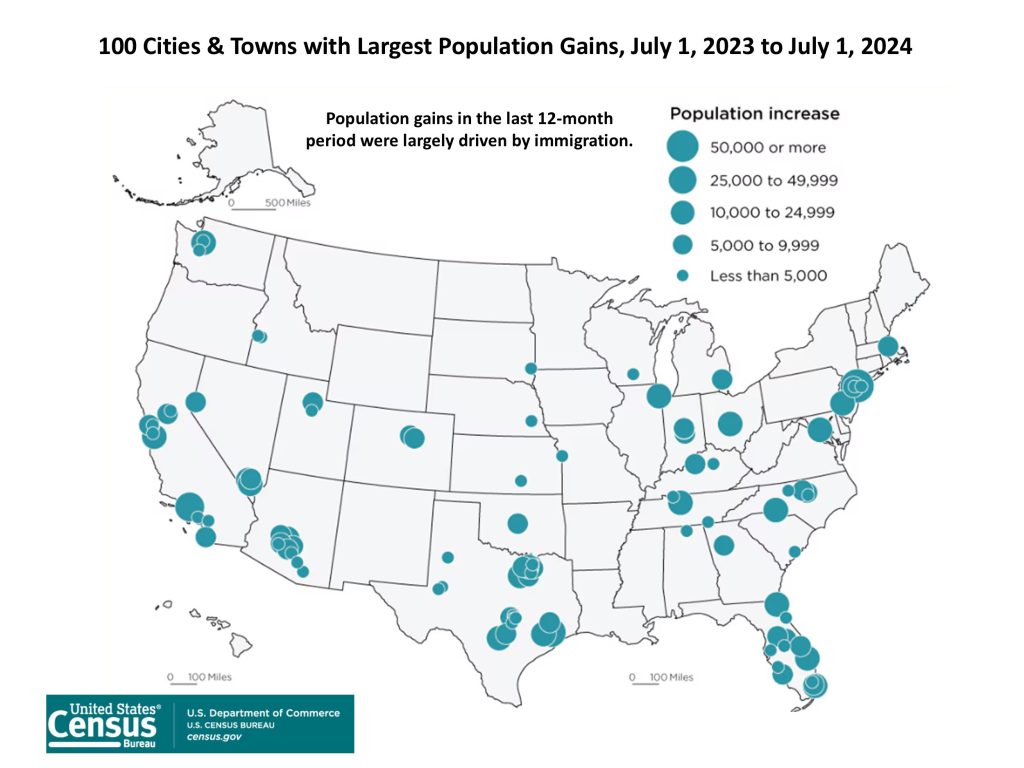

In the last 12-month period measured (through July 1, 2024), population gains were concentrated in urban areas, and mostly driven by immigration. The changes in immigration policies will almost certainly have a substantial impact on this dynamic. Anecdotally, it appears that the quantity of foreign homebuyers is plunging in 2025 due to political considerations, another factor affecting demand in certain markets.

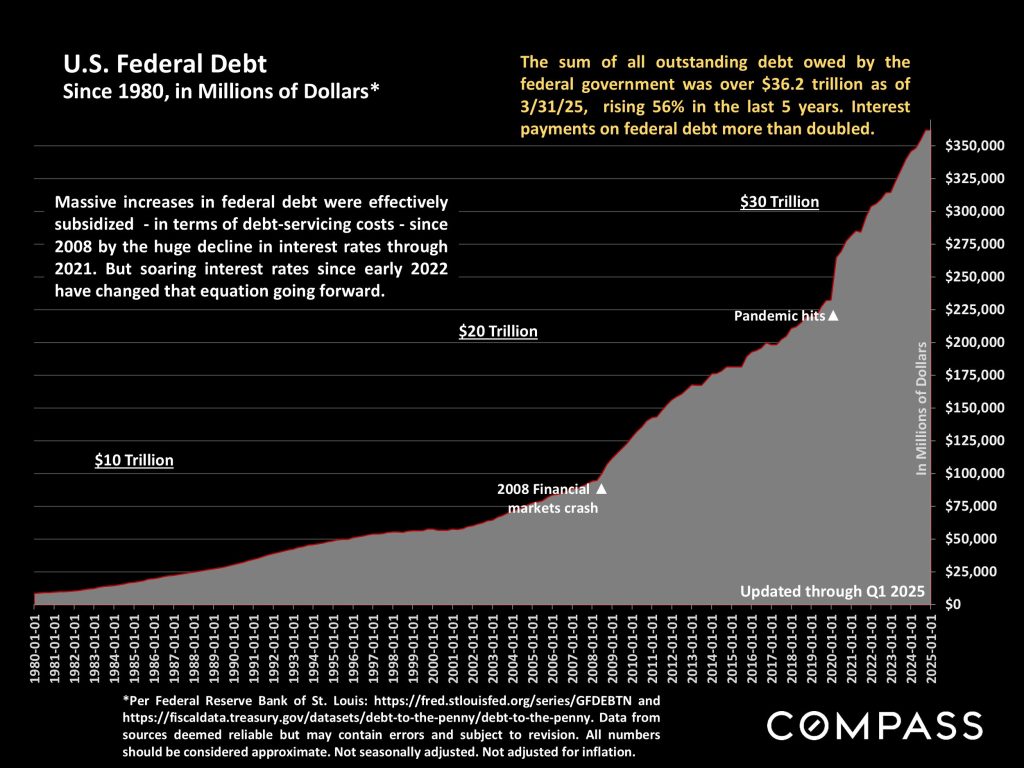

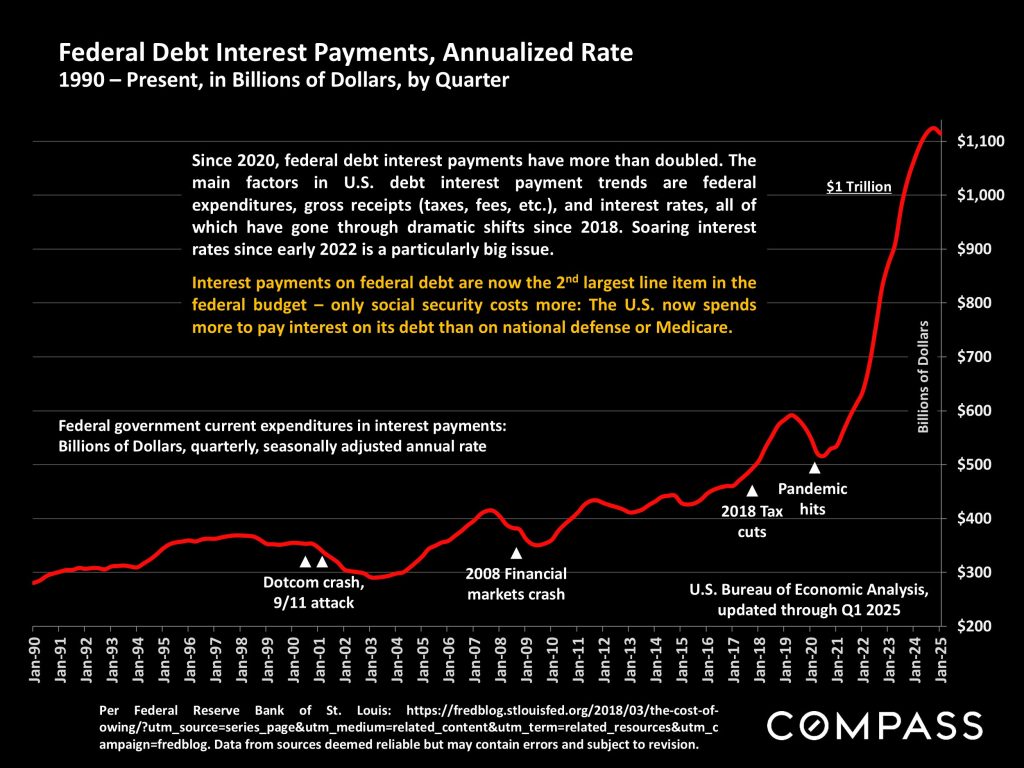

As budget deficits are much in the news with new tax laws being considered, below are 2 charts on the issue. One concern is that rapidly increasing debt will affect investor appetite for U.S. bonds – Moody’s downgraded U.S. debt in May – which could negatively impact interest rates. But there are many considerations at play in interest rates, making it challenging to predict changes.

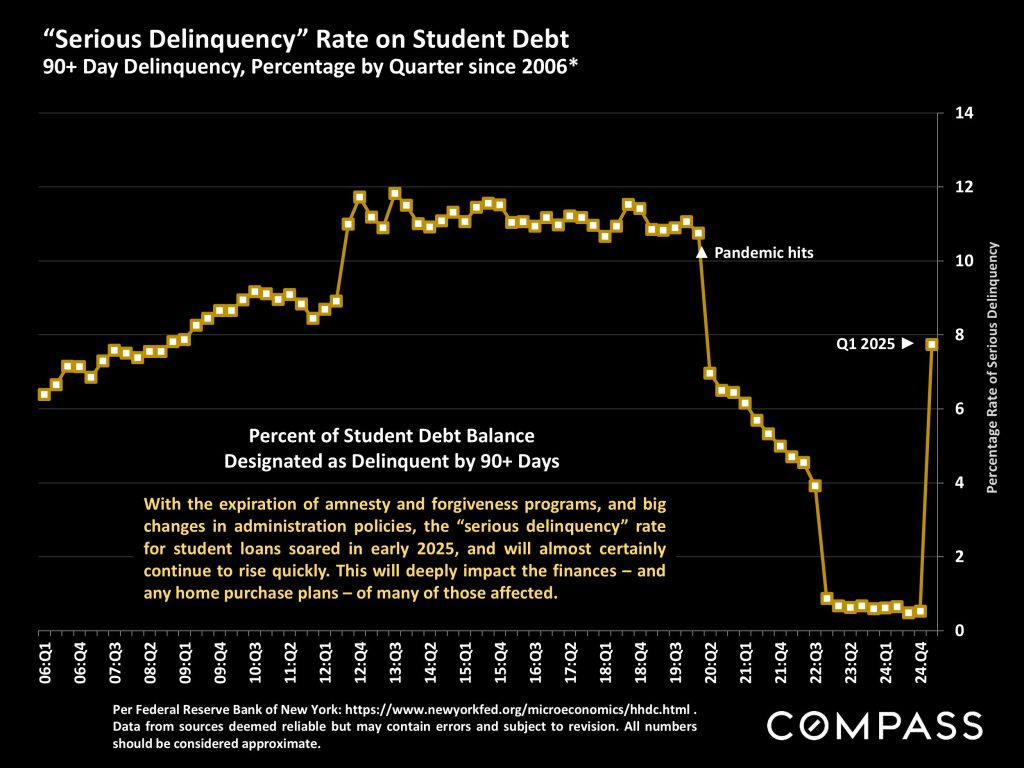

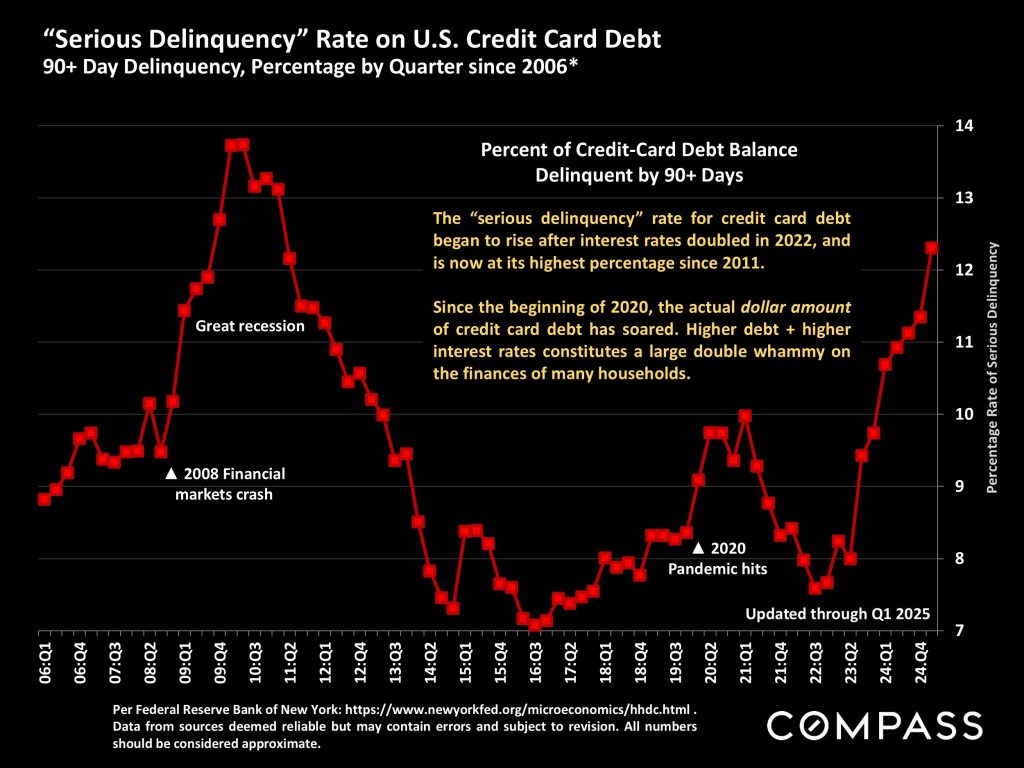

In recent years, more affluent buyers have played a larger role in the market. They have been most positively affected by soaring stock markets and home price appreciation, and typically less affected by interest rates as they are more likely to be able to pay all cash. Other households, especially younger households, have been more likely to experience financial stress, particularly associated with rising debt exacerbated by higher interest rates.