Compass National Real Estate Insights – October 2023

Compass National Real Estate Insights in October 2023

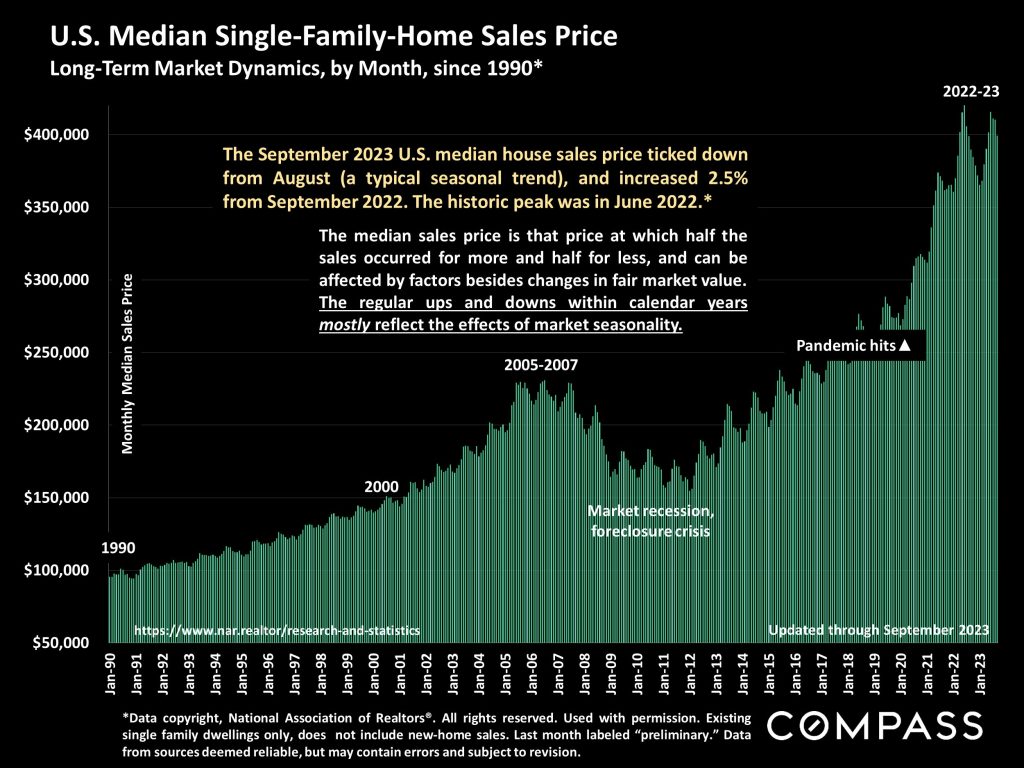

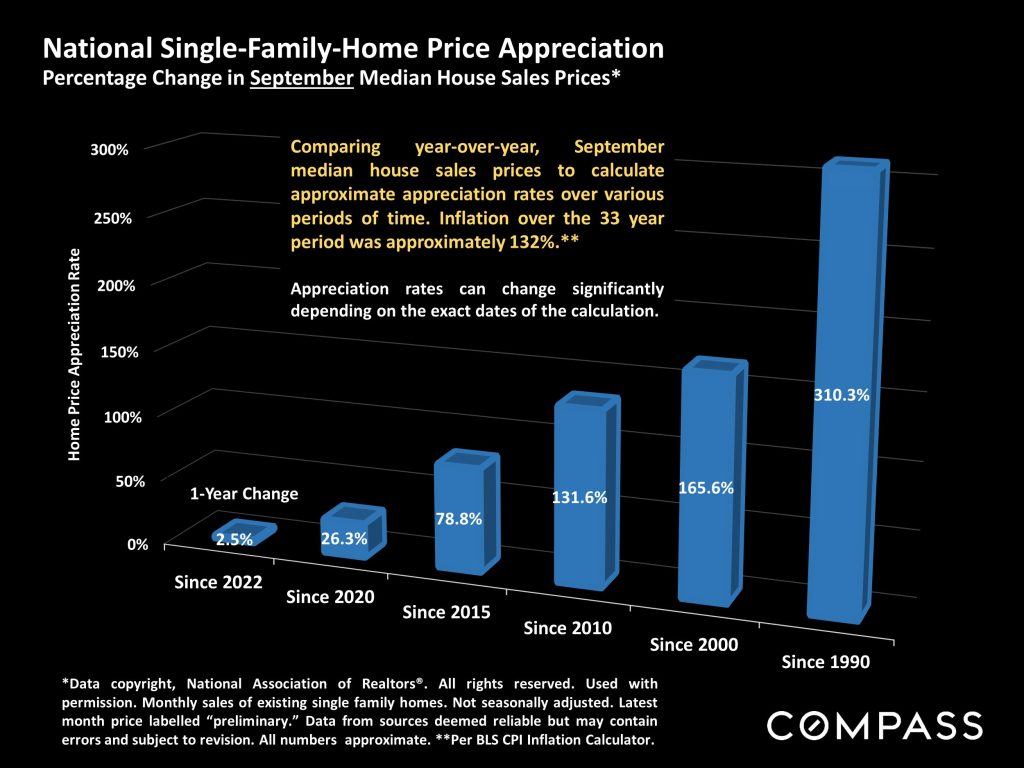

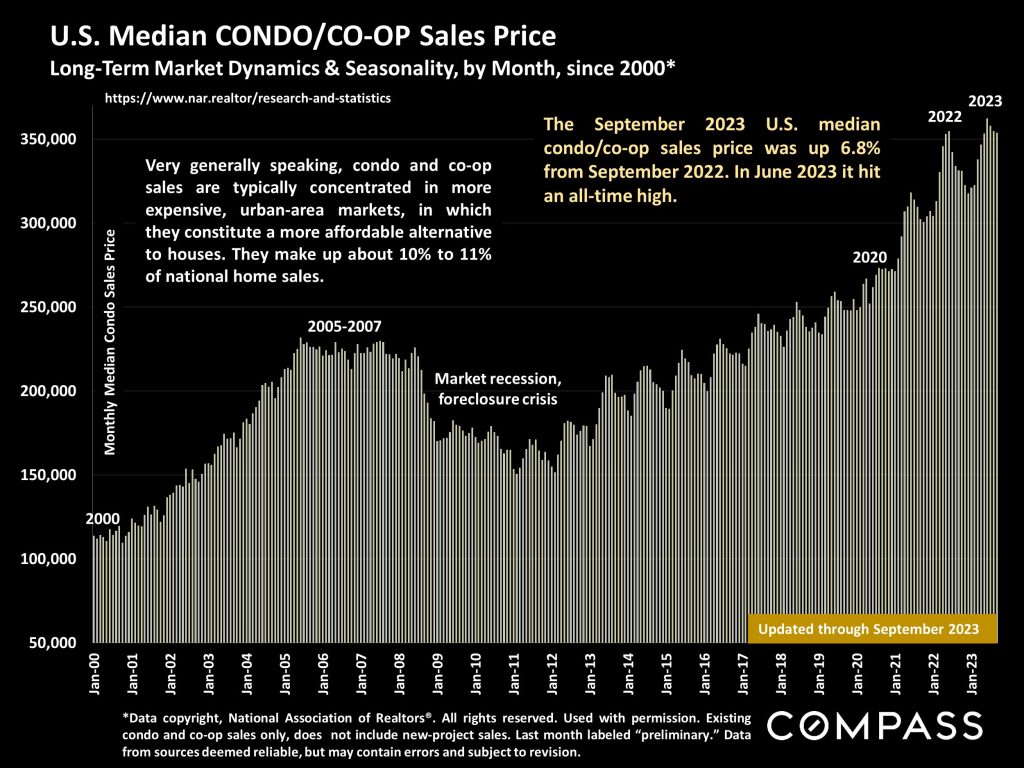

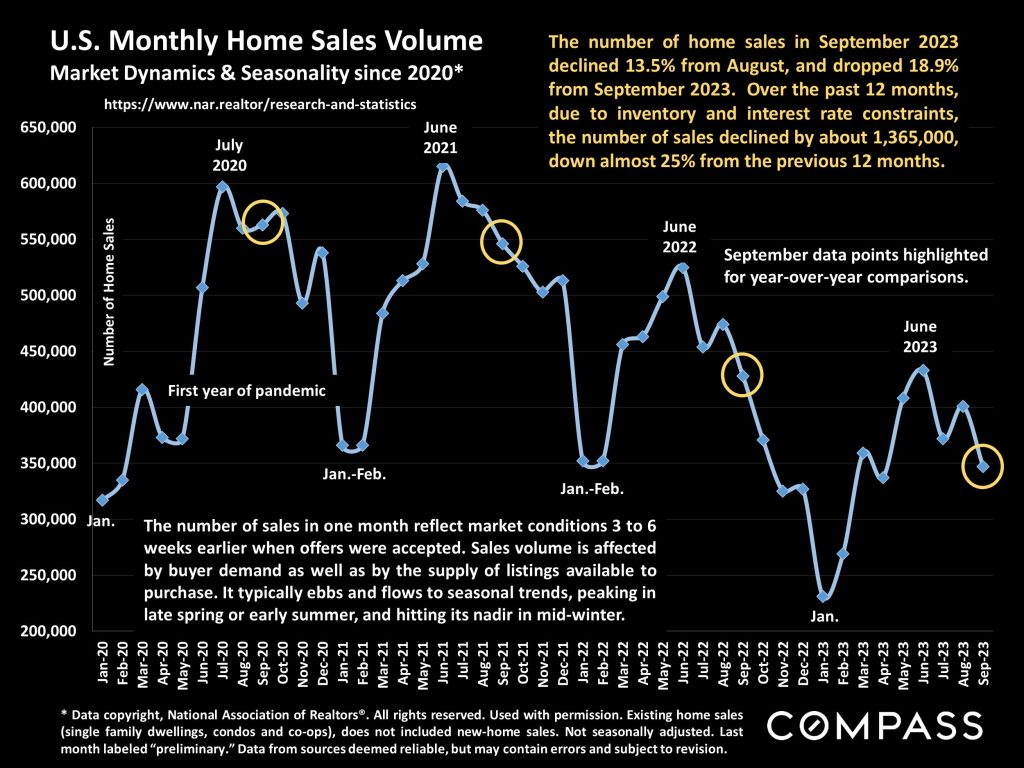

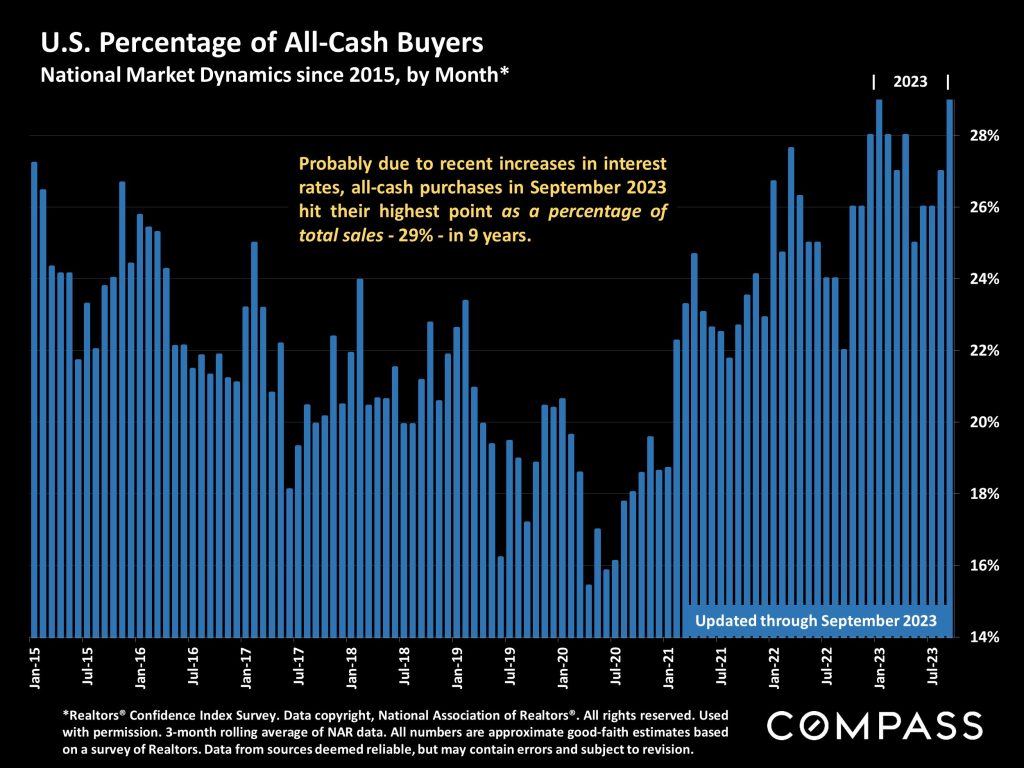

Impacted by both low inventory and economic factors, the number of U.S. existing-home sales in September 2023 dropped 13.5% from August and almost 19% from September 2022. The median house sales price increased 2.5% year over year, while the median condo/co-op price jumped almost 7%. Presumably affected by rising interest rates, all-cash purchases hit their highest share of total sales, 29%, in 9 years. Approximately 69% of sales accepted offers in less than 30 days; 26% sold above list price; and the average number of offers received on sold homes was 2.6.

**Data from the National Association of Realtors 10/19/23

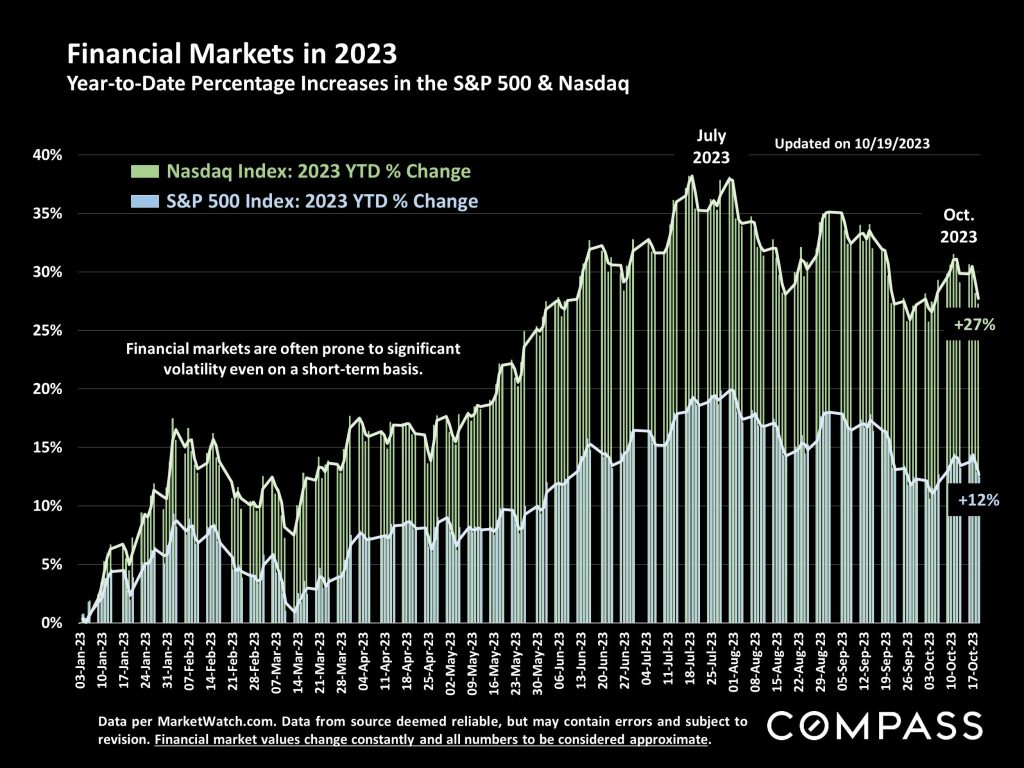

Economic and political challenges – and even environmental factors in some regions – have continued to impact housing markets in recent months. Interest rates rose along with national and international uncertainties; financial markets are well below mid-summer highs, and consumer confidence has ticked down. The supply of listings for sale, though slowly rising, remains very low by historical norms, dramatically affecting market dynamics. Total sales over the past 12 months were the lowest since the 2008-2011 housing market recession. However, as mentioned above, on average, the homes that did sell, sold quickly with multiple offers, and median home sales prices rebounded in 2023 and are currently higher on a year-over-year basis.

In the great majority of U.S. markets, the big, mid-winter holiday slowdown begins in mid-late November. Though buying and selling occur in every month of the year, listing and sales activity usually drop to their lowest levels of the year until activity picks up again in the first quarter.

This report will review broad national trends in home prices, supply and demand, and selected economic indicators. A national report is a huge generalization of trends across and enormous range of regional submarkets, whose values and market dynamics widely vary. National data on October sales should become available in the third week of November.

Monthly median house sales price since 1990: The September 2023 median price declined slightly from August, but was up 2.5% year-over-year.

U.S. median house sales price appreciation since 1990. Over the longer term, homeownership has typically been a great builder of household wealth.

Median condo/co-op sales prices since 2000. In markets in which they are common, condos & co-ops are usually a more affordable alternative to houses.

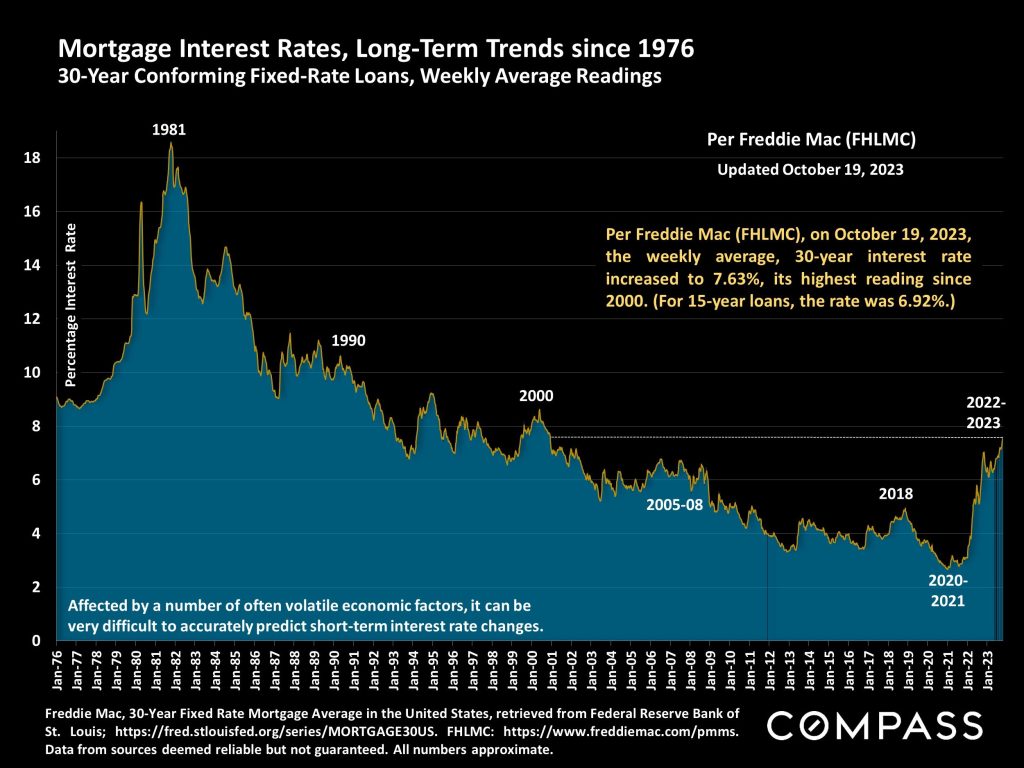

Certainly one of the most important factors in housing markets since 2022 began has been the increase in interest rates, which has continued in recent months.

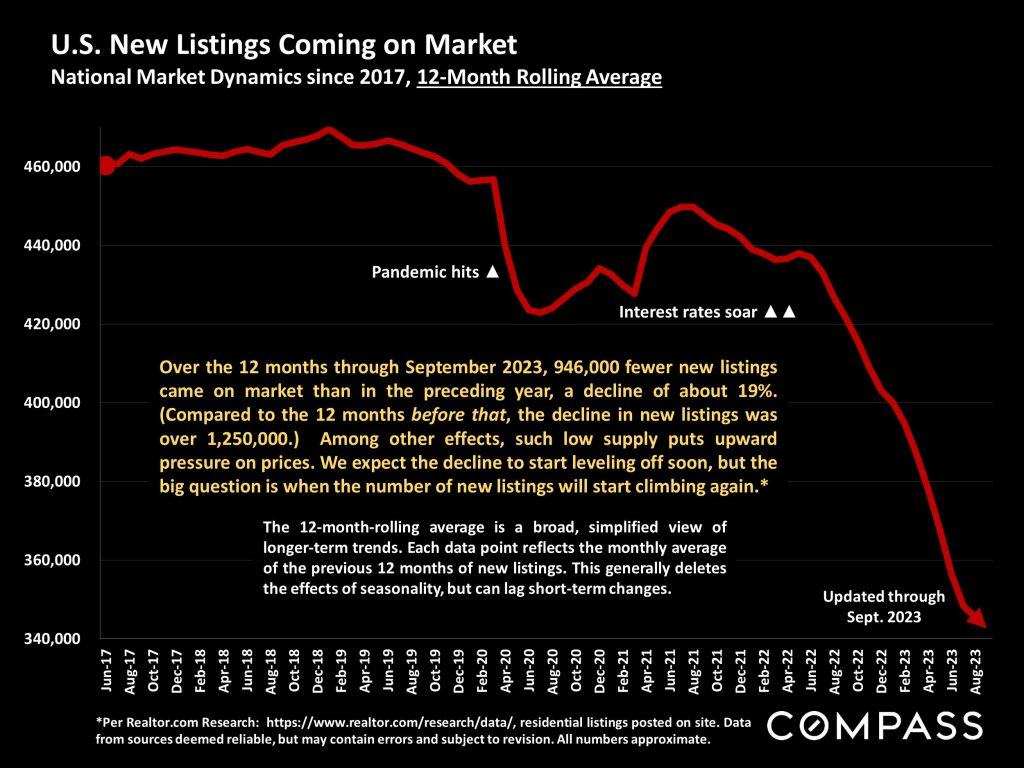

Using 12-month-rolling-average data, a broad illustration of the huge decline in the number of new listings coming on market over the past 6 years.

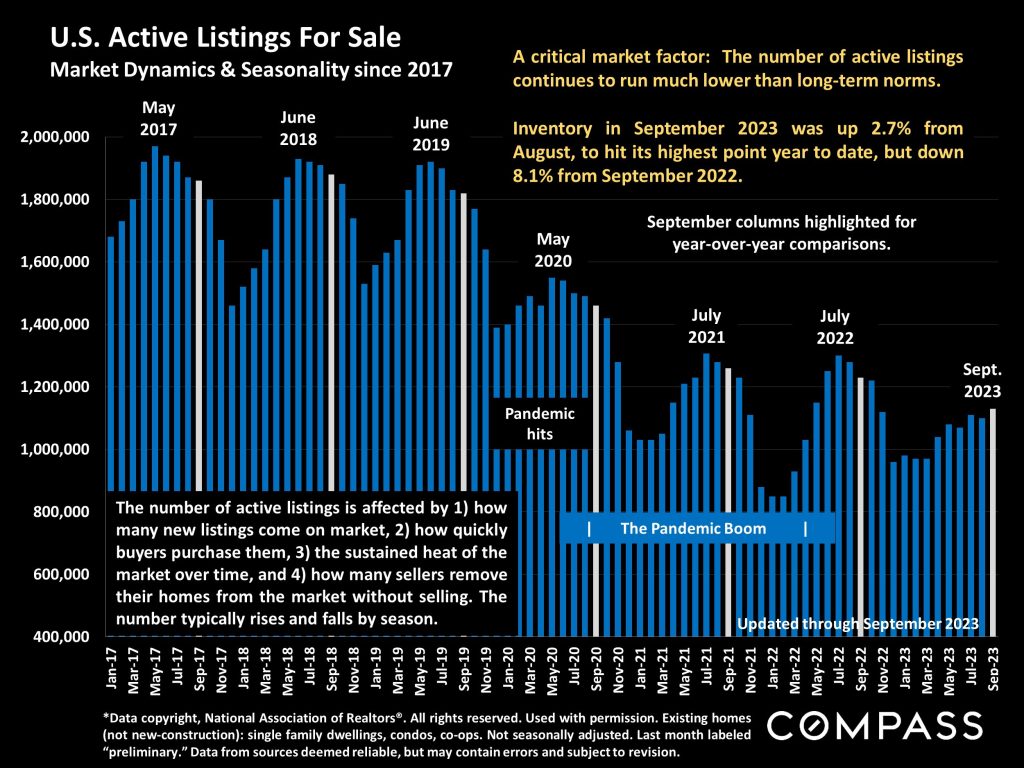

Monthly number of homes for sale: The decline in new listings amid rebounding buyer demand in 2023 has deeply affected supply.

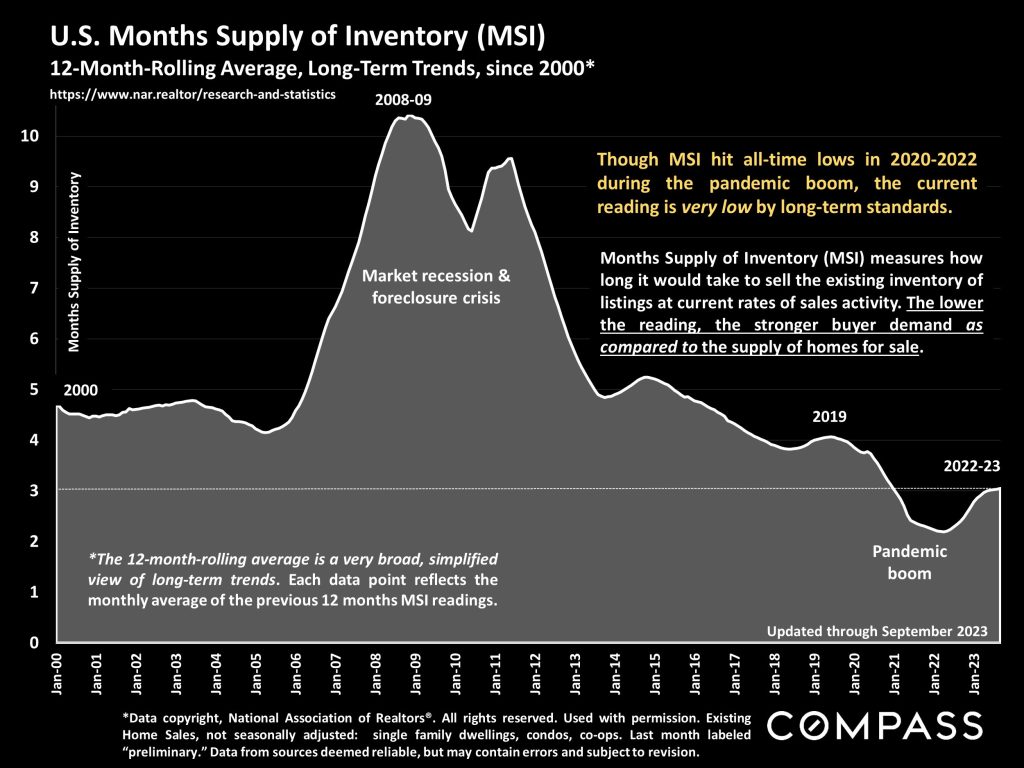

Months Supply of Inventory (MSI) measures the strength of buyer demand as compared to the supply of listings for sale.

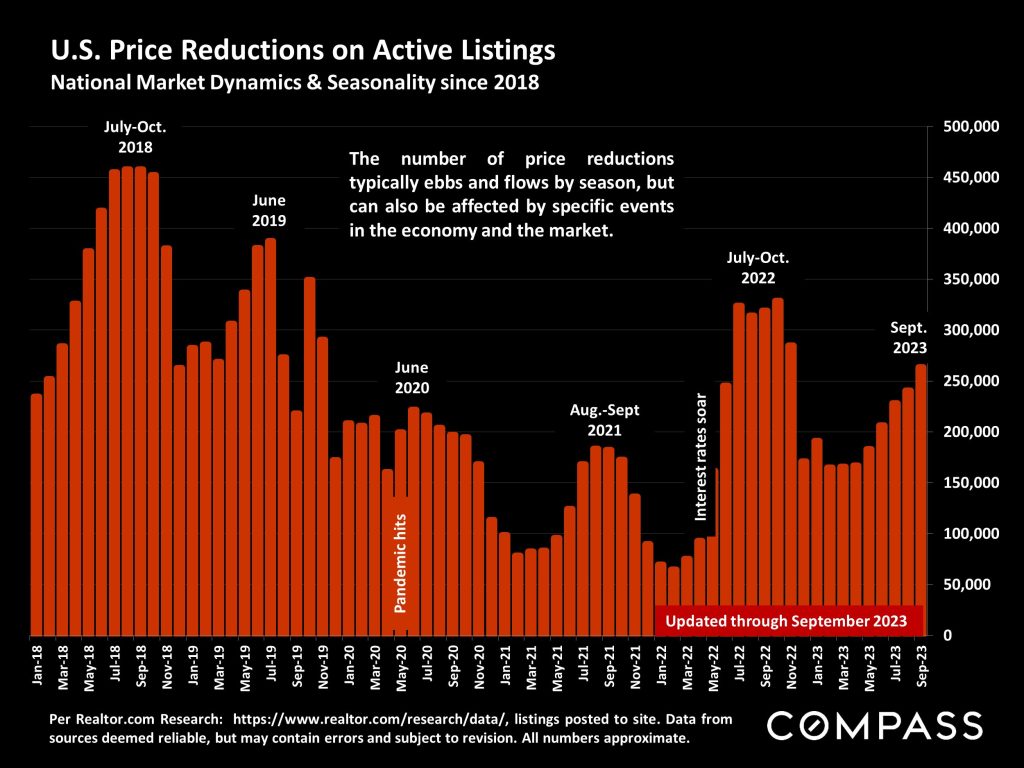

Price reductions have been climbing since spring, a common seasonal trend, especially as we get closer to the mid-winter holiday slowdown.

Monthly number of sales: Economic conditions and low inventory have dramatically impacted monthly and 12-month sales volumes.

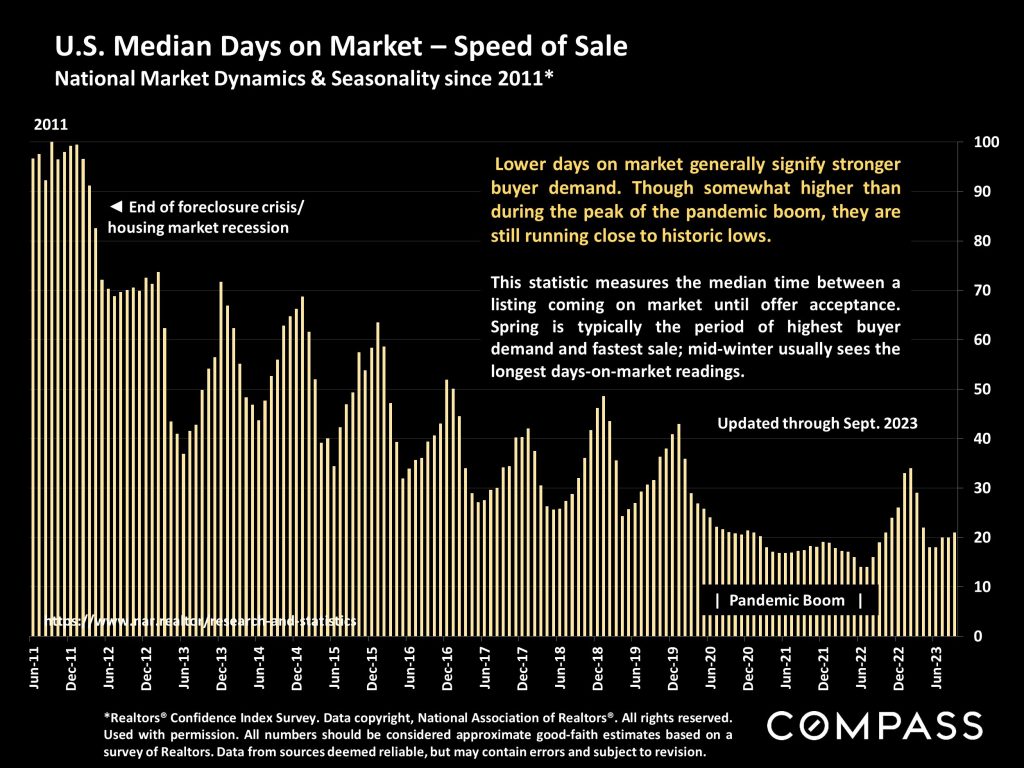

Days on market: Generally speaking, homes continue to sell quite quickly, though not quite as quickly as during the height of the pandemic boom.

As a percentage of total sales, all-cash purchases hit their highest point in 9 years, tying the percentage hit earlier this year.

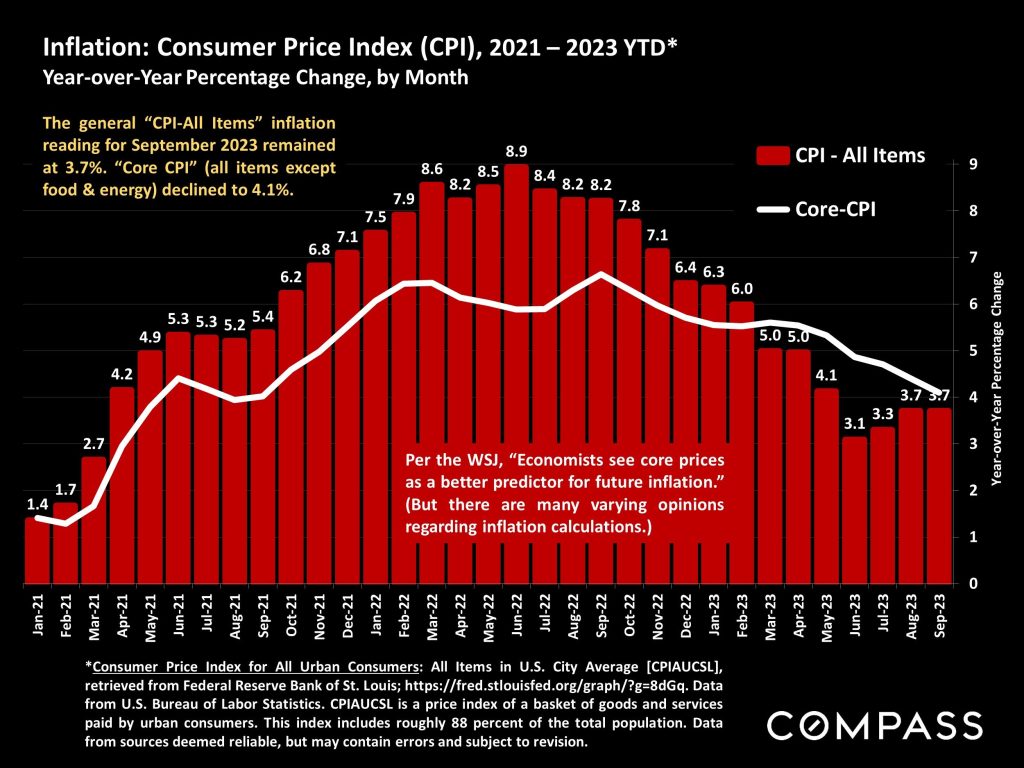

Inflation, the Fed’s greatest concern, has plunged from its mid-2022 high, but has not seen the desired level of improvement in recent months.

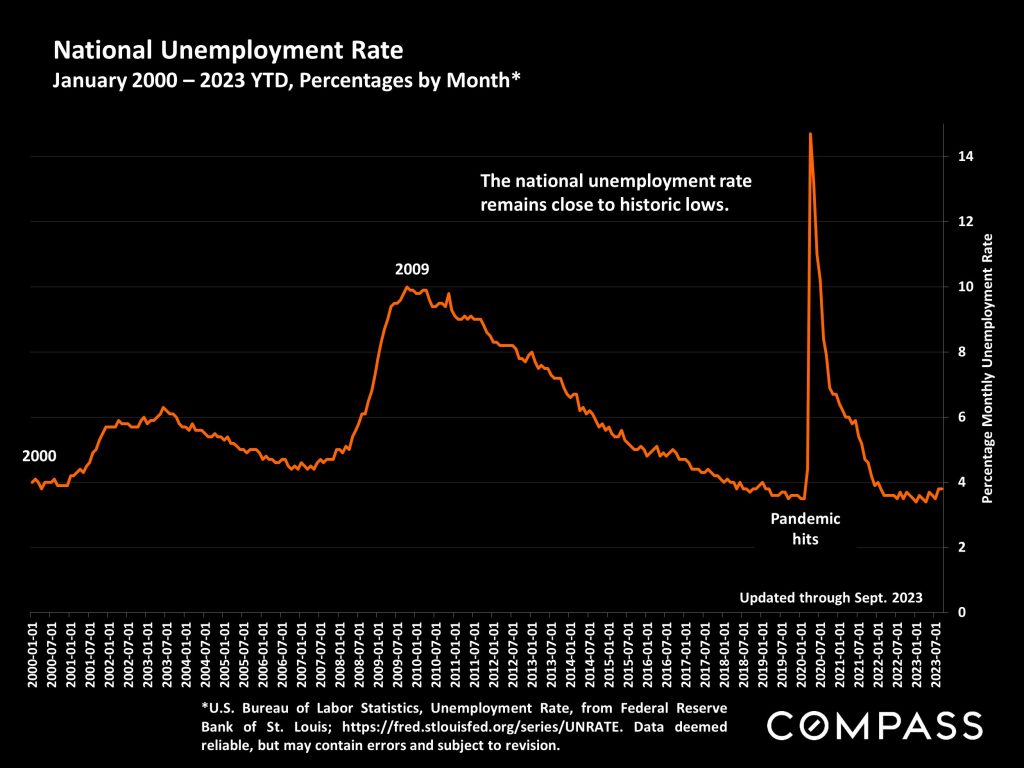

Employment has remained very strong – in fact too strong for many economists and investors watching the Fed and inflation numbers.

Stock markets remain well up in 2023, but amid economic & political uncertainties are significantly down from the YTD peaks of mid-summer.

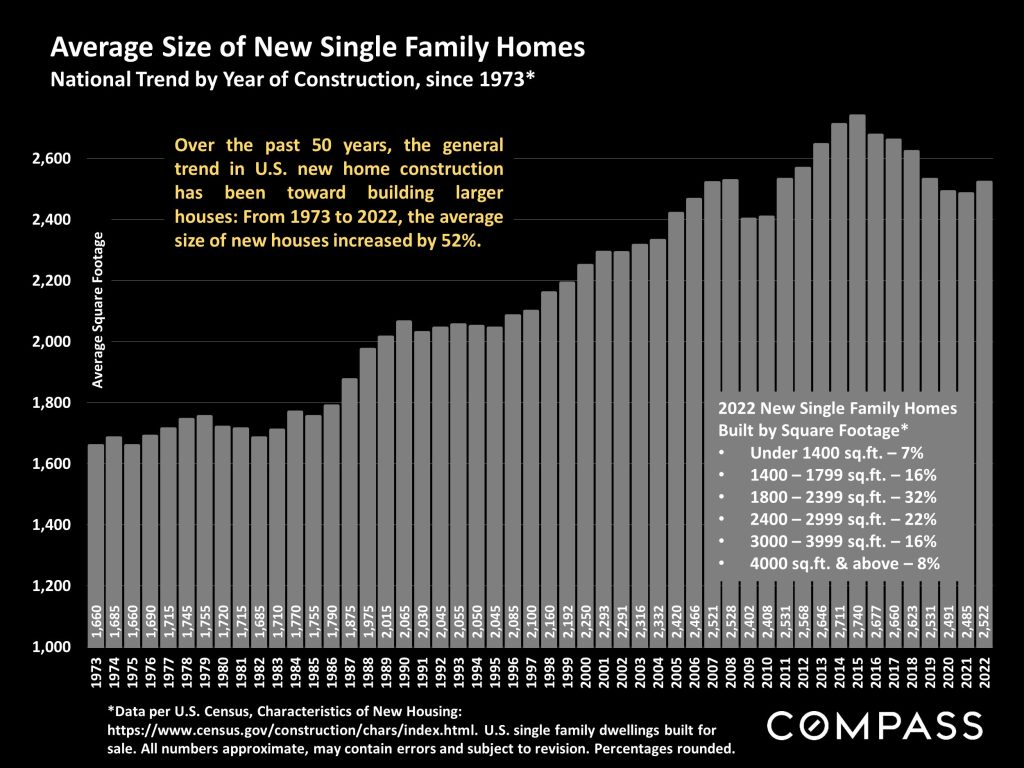

Though generally dropping in recent years, the overall trend in new home construction over the past 50 years has been toward larger houses.

According to RealTrends, Compass sells more residential real estate, in dollar-volume sales, than any other brokerage in the nation.

| Please let us know if we can, in any way, be of assistance to you, or to your family, friends and colleagues. |