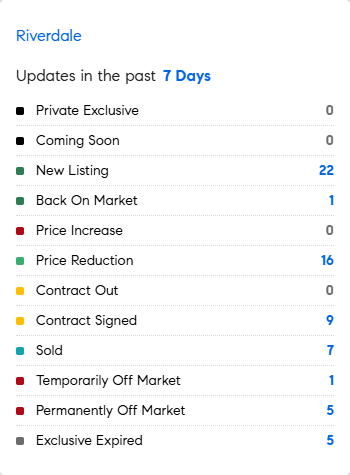

MarketWatch: Weekly Real Estate Update for Riverdale, Bronx – 10/20/2025 – 10/27/2025

Let’s see what the market’s doing this week in the Riverdale area of the Bronx.

Did You Know?

DID YOU KNOW?

* Of all assumable mortgages, half have interest rates of less than 3.5%, mostly on loans $400,000 and lower. Of Assumable active listings, more than half have mortgage interest rates between 2% and 3.5%. Roughly 6.8 million loans are assumable at a rate of 4% or below, and 4.8 million have rates of 3.5% or less. Assuming a loan is not fast or easy. (FT)

* The U.S. unemployment rate for people aged 20 to 24 was 9.2% in August, more than double the overall rate. Last month, national average rent fell 0.3% from August, the steepest September drop in more than 15 years. (WSJ)

“There was a saying: ‘Stay alive until 2025,’” We’re in the camp, ‘We’ll be in heaven in 2027.’”

– David Schwartz, CEO Waterton referring to the over-supply in areas of rental properties that has resulted in some rents dipping and incentives growing.

* Owning collector-grade furnishings requires collector-level maintenance….including cleaning staff that understand exactly how to clean these often fragile and highly finished pieces. Ultra-high end housekeepers and cleaners are now earning record pay….sometimes $100k and more. (Bloomberg)

* Is Ferrari leading a new trend? Many people are becoming frustrated with screens to control almost everything in life: Ferrari is moving away from finicky touch-sensitive controls and going back to buttons. The company will use “digital where it’s needed, and physical where it’s needed.” (Bloomberg)

Mortgage Rate Updates:

The average rate on a 30-year fixed mortgage eased to 6.19% as of October 23rd, 2025, down from 6.27% in the previous week and marking the third straight weekly decline to the lowest in over a year, according to a survey of lenders by mortgage giant Freddie Mac. “Mortgage rates continued to trend down this week, hitting their lowest level in over a year. At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower. This dynamic has kept refinancings high, accounting for more than half of all mortgage activity for the sixth consecutive week,” said Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac